3i Infotech Share Price Target 2025 to 2030: When it comes to mid-tier IT companies with a focus on innovation and transformation, 3i Infotech stands out as a name worth exploring. Over the years, this IT company has transitioned from being a core product-based player to an end-to-end IT services provider, creating a unique niche in the competitive landscape. With a renewed focus on futuristic technologies and a strategic roadmap, 3i Infotech is positioning itself as a potential multibagger for long-term investors.

This article delves deep into 3i Infotech’s current financial standing, growth strategies, market opportunities, and projected share price targets from 2025 to 2030.

Current Financial Overview

To understand the prospects of 3i Infotech, it is crucial to analyze its current financial health and market performance. As of December 27, 2024, the company is trading at ₹28.32 per share. Below are key financial metrics that define its market standing:

| Parameter | Value |

|---|---|

| Current Share Price | ₹28.32 |

| Market Capitalization | ₹480 crore |

| Book Value | ₹16.6 |

| 52-Week High/Low | ₹63.9 / ₹25.2 |

| Price-to-Earnings (P/E) Ratio | Negative (Loss-Making) |

| Return on Capital Employed (ROCE) | -7.07% |

| Return on Equity (ROE) | -15% |

These figures highlight that while the company faces challenges in profitability, it retains substantial growth potential due to its strategic vision.

3i Infotech’s Vision for 2030

1. Ambitious Growth Targets:

3i Infotech aims to achieve $1 billion in revenue by 2030, a goal that underscores its commitment to exponential growth. This transformation involves diversifying its product portfolio and tapping into global markets.

2. Focus on Emerging Technologies:

The company is investing heavily in artificial intelligence, blockchain, cloud computing, and IoT (Internet of Things). These are industries forecasted to grow exponentially, and 3i Infotech’s involvement places it in a sweet spot for the future.

3. Expanding Client Base:

From BFSI (Banking, Financial Services, and Insurance) to retail and manufacturing, 3i Infotech is diversifying its clientele across multiple industries, creating more revenue streams.

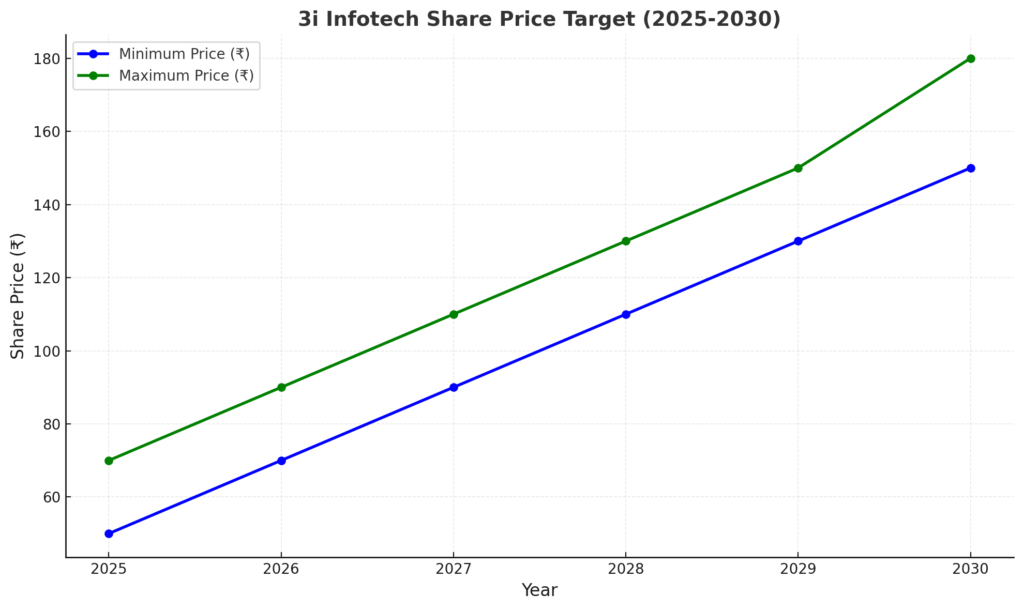

Projected Share Price Targets (2025-2030)

Based on financial analysis, market trends, and the company’s strategies, here’s a detailed table of 3i Infotech’s share price targets for the next six years:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹50 | ₹70 |

| 2026 | ₹70 | ₹90 |

| 2027 | ₹90 | ₹110 |

| 2028 | ₹110 | ₹130 |

| 2029 | ₹130 | ₹150 |

| 2030 | ₹150 | ₹180 |

Graphical Representation

To provide a visual understanding of the company’s projected growth, here’s a graph representing the expected share price movement:

Growth Catalysts for 3i Infotech

1. Digital Transformation:

With organizations worldwide embracing digital transformation, 3i Infotech is capitalizing on this trend. Its expertise in automation and IT solutions makes it a go-to choice for clients seeking cost-effective and cutting-edge solutions.

2. Global Market Expansion:

The company’s strategic move into global markets, especially North America and Europe, has the potential to drive significant revenue growth.

3. Innovation-Driven Strategy:

3i Infotech’s focus on innovation is expected to yield proprietary products and services, giving it a competitive edge.

4. Increasing Demand for IT Services in India:

As Indian businesses become increasingly reliant on IT infrastructure, 3i Infotech is well-positioned to cater to this demand.

Challenges and Risks

While the growth potential is significant, investors must remain cautious of the following risks:

- Competition: The IT services sector is highly competitive, with major players like TCS, Infosys, and Wipro dominating the space.

- Economic Volatility: Recession or slowdown in key markets could impact IT spending.

- Profitability Issues: The company is currently not profitable, which could pose challenges in securing large-scale contracts.

Why Should You Invest in 3i Infotech?

For investors looking for potential multibaggers, 3i Infotech offers:

Sectoral Tailwinds: The IT sector is poised for robust growth, and companies like 3i Infotech will benefit from this macroeconomic trend.

High Growth Potential: The company’s aggressive expansion plans and focus on emerging technologies make it a promising bet.

Undervalued Stock: Trading at a relatively low valuation compared to its peers, 3i Infotech could deliver significant returns if it executes its plans effectively.

Conclusion: 3i Infotech Share Price Target 2025 to 2030

3i Infotech represents a mix of high risk and high reward. Its ambitious plans for growth, coupled with its investments in emerging technologies, make it a promising stock for long-term investors. However, potential investors must weigh the risks, including competition and profitability concerns.

As we look ahead to 2030, 3i Infotech’s ability to innovate and execute its strategic plans will determine whether it can deliver on its ambitious goals. For now, the projections suggest significant upside potential for those willing to ride out the volatility.