Tata Steel Share Price Target 2025 to 2030: Tata Steel, a global giant in the steel industry and a cornerstone of India’s industrial success, has been a significant player in the stock market for decades. With its legacy of innovation and robust expansion plans, the company continues to draw the attention of investors.

This article offers an in-depth analysis of Tata Steel’s share price target for 2025 to 2030, backed by financial data, growth forecasts, and visual insights to help investors make informed decisions.

Overview of Tata Steel

Founded in 1907, Tata Steel is one of the world’s most geographically diversified steel producers.

With a capacity of over 34 million tons per annum and operations spanning 26 countries, Tata Steel has consistently demonstrated resilience and adaptability. The company’s strong focus on sustainability, digital transformation, and capacity expansion underscores its growth potential.

Key Financial Metrics

- Market Capitalization: Over ₹1.5 Lakh Crore

- Revenue Growth: CAGR of 8% over the last 5 years

- Profit Margins: 12%-15%

- Debt-to-Equity Ratio: 1.2 (Well-managed for a capital-intensive industry)

HUDCO Stock Target 2025: Will It Outperform Market Expectations?

Factors Influencing Tata Steel Share Price

1. Global Demand for Steel

The global steel market is projected to grow at a CAGR of 4.1% between 2023 and 2030. Tata Steel’s global presence positions it well to capitalize on this growth, especially in high-demand regions like Europe and Southeast Asia.

2. Expansion Plans

Tata Steel is investing heavily in:

- Increasing production capacity in India.

- Expanding its high-margin product portfolio.

- Strengthening its presence in renewable energy-driven steel production.

3. Sustainability Initiatives

The company’s commitment to carbon neutrality by 2045 includes adopting electric arc furnaces and recycling initiatives. These efforts align with global ESG (Environmental, Social, and Governance) trends, enhancing its appeal to institutional investors.

4. Government Support

The Indian government’s push for infrastructure development and the Production-Linked Incentive (PLI) schemes for the steel sector further bolster Tata Steel’s growth prospects.

HDFC Bank Share Price Target 2025: A Comprehensive Investor’s Guide

Tata Steel Share Price Target 2025 to 2030

| Year | Expected Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | Share Price Target (₹) |

|---|---|---|---|---|

| 2025 | 2,30,000 | 22,000 | 80 | 1,400-1,600 |

| 2026 | 2,50,000 | 25,000 | 90 | 1,600-1,800 |

| 2027 | 2,80,000 | 30,000 | 110 | 1,800-2,200 |

| 2028 | 3,10,000 | 34,000 | 125 | 2,200-2,600 |

| 2029 | 3,50,000 | 38,000 | 140 | 2,600-3,000 |

| 2030 | 3,90,000 | 42,000 | 155 | 3,000-3,500 |

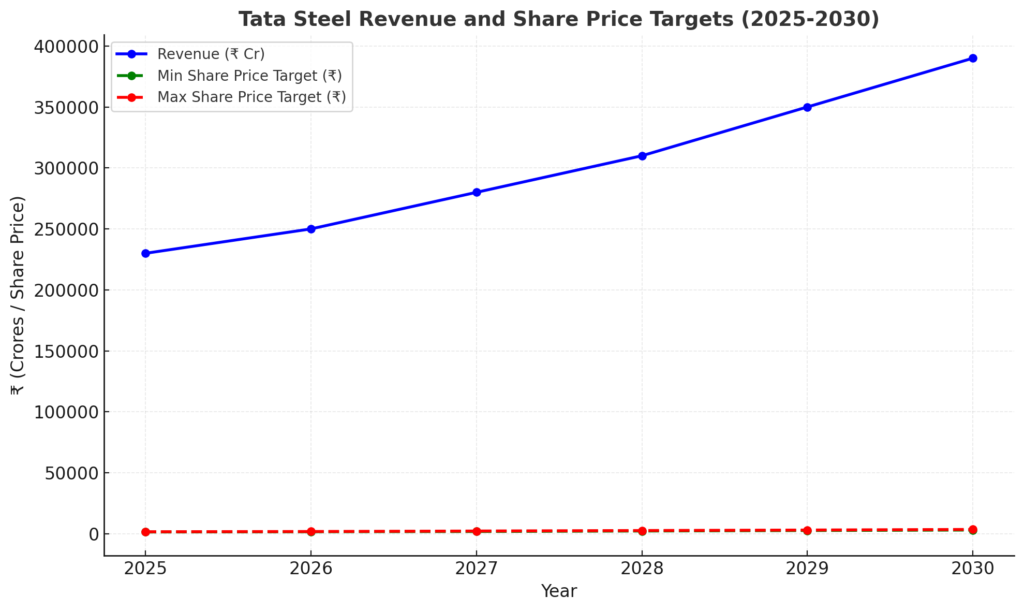

Graphical Representation of Growth Projections

Below is a graph illustrating Tata Steel’s expected revenue and share price growth from 2025 to 2030.

Investment Potential

1. Short-Term Outlook (2025)

Tata Steel is likely to achieve a share price target of ₹1,400-1,600 by 2025, supported by increased domestic steel consumption and improved export margins.

2. Medium-Term Growth (2026-2028)

With enhanced production capabilities and a diversified product mix, the company is poised to deliver consistent returns, with share prices expected to touch ₹2,200-2,600 by 2028.

3. Long-Term Prospects (2029-2030)

By 2030, Tata Steel aims to lead the global steel market in sustainability and innovation. Its robust financial health and strategic initiatives could push the share price to ₹3,000-3,500.

Risks to Consider

While Tata Steel offers a compelling growth narrative, investors should remain cautious of:

- Cyclicality of the Steel Industry: Demand fluctuations and price volatility.

- Geopolitical Risks: Trade wars and tariffs impacting global operations.

- High Debt Levels: Managing debt efficiently will remain crucial.

Conclusion: Tata Steel Share Price Target 2025 to 2030

Tata Steel presents a promising investment opportunity for those seeking long-term growth in the steel sector. The company’s strong fundamentals, ambitious growth plans, and commitment to sustainability position it as a frontrunner in the industry. By 2030, Tata Steel is expected to not only maintain its leadership but also deliver substantial returns to its investors.

Investors are advised to consider their risk appetite and conduct thorough research before making investment decisions. With Tata Steel’s unwavering focus on innovation and expansion, the future looks bright for both the company and its shareholders.