RVNL Share Price Target 2025 to 2030: India is on the cusp of a major transformation, and at the heart of this growth story is Rail Vikas Nigam Limited (RVNL). This public sector giant, responsible for building India’s rail network, has become a beacon of opportunity for investors looking to ride the wave of infrastructure-led growth. If you’re someone seeking stable yet explosive returns, RVNL could very well be the stock to watch from 2025 to 2030.

But why is RVNL the darling of long-term investors? And how can its share price evolve in the coming years? Let’s dive into an in-depth analysis to uncover its true potential.

A Quick Look at RVNL Today

As of December 2024, RVNL’s share price is trading at ₹396, showing consistent upward momentum. Bolstered by robust government support and its essential role in India’s rail modernization, RVNL is well-positioned to achieve staggering growth over the next decade.

The Big Question: Can RVNL’s share price cross ₹2,000 by 2030?

Financial Analysis: Why RVNL Is a Promising Bet?

RVNL’s financials paint a compelling picture for investors. Here are some highlights:

- Revenue Growth: The company has shown steady revenue growth year-on-year, with projections indicating further acceleration.

- Profit Margins: RVNL’s efficient execution and low-cost model contribute to healthy profit margins.

- Debt Management: Being government-backed, RVNL has access to favorable borrowing rates, ensuring manageable debt levels.

VNL Share Price Target: 2025 to 2030

Based on a combination of expert forecasts, market trends, and financial analysis, RVNL’s share price target for 2025 to 2030 is as follows:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹333 | ₹488 |

| 2026 | ₹812 | ₹857 |

| 2027 | ₹1,139 | ₹1,183 |

| 2028 | ₹1,469 | ₹1,514 |

| 2029 | ₹1,794 | ₹1,838 |

| 2030 | ₹2,119 | ₹2,163 |

The projections above are sourced from reliable market analyses, offering a strong foundation for investors planning their next move.

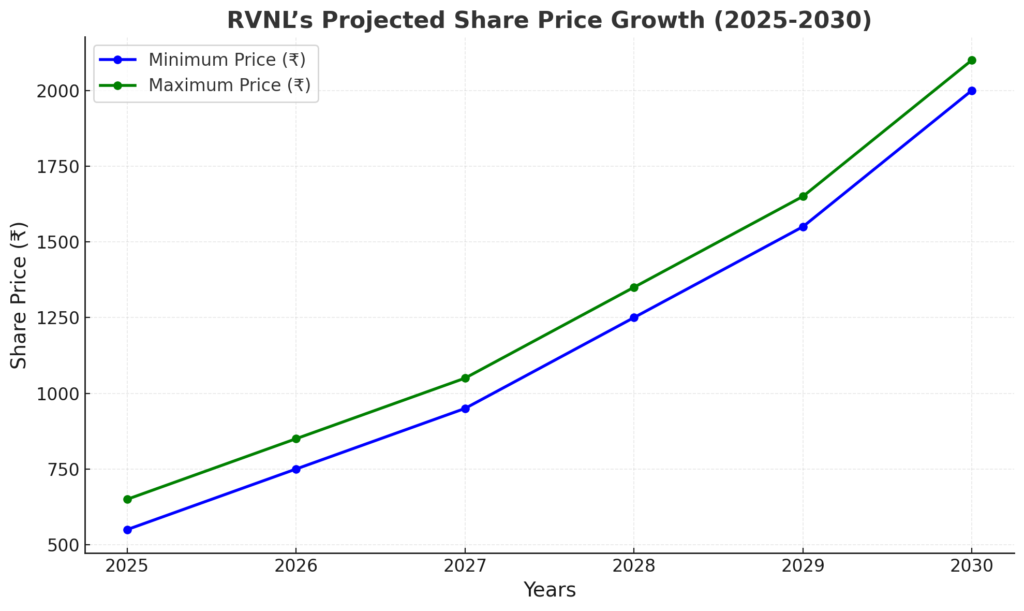

Graphical Representation: RVNL’s Projected Growth Over the Years

Here is a graphical representation of RVNL’s projected share price growth:

As seen above, RVNL is projected to grow consistently, with its share price crossing ₹2,000 by 2030.

What Makes RVNL a Star Performer?

RVNL’s potential lies in its core strengths and market position. Let’s explore the key factors that are expected to drive its growth:

1. India’s Unstoppable Infrastructure Push

RVNL plays a pivotal role in India’s railway expansion. From electrification projects to building new rail lines, the company is the backbone of a modern, sustainable rail network.

2. Massive Government Backing

Being a PSU, RVNL benefits from government funding, contracts, and policies designed to accelerate rail infrastructure. The budgetary focus on infrastructure ensures a steady stream of high-value projects.

3. Sustainability and Electrification

With India aiming for 100% railway electrification by 2030, RVNL is spearheading this green revolution. This initiative alone is expected to contribute significantly to its revenue growth.

4. Strong Order Book

RVNL’s robust pipeline of projects ensures consistent revenue inflows. Its well-managed order book reflects financial discipline and operational efficiency, crucial for long-term investor confidence.

5. Attractive Valuation and Dividend Yield

RVNL, like many PSUs, has a history of rewarding investors with dividends. Combine that with its growth prospects, and you have a rare blend of stability and high returns.

Year-Wise Breakdown of RVNL’s Share Price Projections

2025: ₹333 to ₹488

In 2025, RVNL is expected to consolidate its position with ongoing projects. The share price may see moderate growth as the company gears up for larger initiatives.

2026: ₹812 to ₹857

By 2026, RVNL’s electrification and expansion projects will gain momentum, driving its share price closer to ₹850.

2027: ₹1,139 to ₹1,183

RVNL will likely solidify its dominance in the railway sector by 2027, pushing its share price well beyond ₹1,100.

2028: ₹1,469 to ₹1,514

With international collaborations and advanced technologies, RVNL’s capabilities will enhance further, reflecting in its share price crossing ₹1,500.

2029: ₹1,794 to ₹1,838

A favorable policy environment and growing demand for rail infrastructure will likely push RVNL’s share price near ₹1,800 by 2029.

2030: ₹2,119 to ₹2,163

By 2030, RVNL is expected to reach its peak growth phase, with its share price crossing the ₹2,000 mark, a monumental achievement for any stock.

Why RVNL Is a Long-Term Investor’s Dream?

- High Growth Potential: RVNL’s role in India’s infrastructure story ensures consistent growth for years to come.

- Dividend Payouts: Enjoy regular income while watching your investment appreciate.

- Low Risk, High Reward: Backed by the government, RVNL offers a rare combination of stability and growth.

Conclusion: Why RVNL is a Must-Watch Stock?

Investing in RVNL is more than just a financial decision, it’s a chance to be part of India’s transformation. With its unmatched growth potential, government backing, and strategic importance, RVNL is poised to deliver exceptional returns by 2030.

Whether you’re a seasoned investor or a first-timer, RVNL’s story of consistent growth and stability is hard to ignore. Don’t just invest in a stock; invest in the future of India.