Zen Technologies Share Price Target 2025 to 2030: Zen Technologies, a leader in defense training and simulation solutions, has been a standout performer in India’s emerging defense sector. With the increasing focus on indigenization and government support for domestic defense manufacturing, Zen Technologies has captured the attention of investors. In this article, we will explore Zen Technologies’ share price targets for 2025 to 2030, its financial health, market trends, and future prospects. This analysis includes a graphical representation, detailed tables, and insights into why this stock could be a gem in the long run.

Market Overview

The Defense Boom in India

India is rapidly modernizing its defense capabilities with significant budget allocations. The Indian government’s “Make in India” initiative and the push for self-reliance in defense manufacturing have opened new avenues for companies like Zen Technologies.

With a strong portfolio of products, including combat training simulators, anti-drone systems, and live-range equipment, Zen Technologies stands well-positioned to benefit from this growing demand.

Global Trends in Defense and Simulation Technology

Globally, the defense simulation market is projected to grow at a CAGR of 6.8% from 2023 to 2030. As nations increasingly adopt advanced training systems to enhance combat readiness, companies like Zen Technologies are set to capitalize on this trend.

Zen Technologies: Company Snapshot

Headquarters: Hyderabad, India

Key Products: Combat training simulators, anti-drone systems, live-range equipment

Current Share Price (As of December 2024): ₹2340

Market Capitalization: Approximately ₹14,000 crore

Key Strengths: High R&D investment, strong order book, and government support

Financial Performance

Revenue Growth

Zen Technologies has demonstrated consistent revenue growth, supported by a robust order book and a steady stream of government contracts:

| Year | Revenue (₹ Crore) | Growth (YoY) |

|---|---|---|

| FY 2022 | 500 | – |

| FY 2023 | 725 | 45% |

| FY 2024 | 1,050 | 44.83% |

Profitability

The company’s profitability has seen a significant rise, reflecting operational efficiencies:

| Year | Net Profit (₹ Crore) | Profit Margin (%) |

| FY 2022 | 80 | 16% |

| FY 2023 | 120 | 17% |

| FY 2024 | 175 | 16.7% |

Debt and Asset Quality

Zen Technologies maintains a low-debt profile with a debt-to-equity ratio of 0.2, ensuring financial stability. This positions the company well to pursue future growth opportunities.

Zen Technologies Share Price Targets: 2025 to 2030

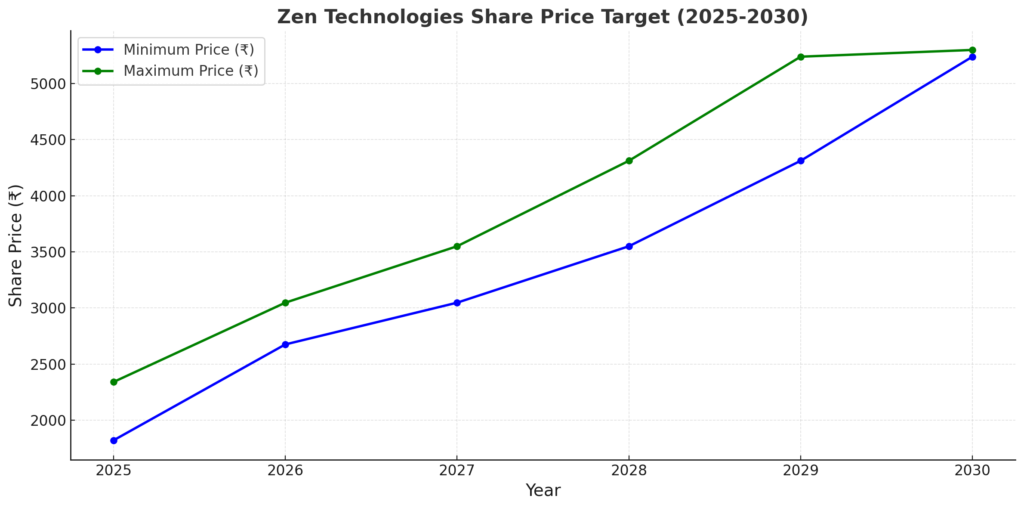

Based on the company’s financial performance, market trends, and growth potential, here are the projected share price targets:

| Year | Minimum Price (₹) | Maximum Price (₹) |

| 2025 | 1820 | 2340 |

| 2026 | 2675 | 3047 |

| 2027 | 3047 | 3550 |

| 2028 | 3550 | 4312 |

| 2029 | 4312 | 5240 |

| 2030 | 5240 | 5300 |

Graphical Representation | Zen Technologies Share Price Target 2025 to 2030

Below is a graphical representation of Zen Technologies’ share price targets from 2025 to 2030:

Risks to Consider

- Regulatory Changes: Changes in defense procurement policies or government budgets could impact revenues.

- Market Competition: Increased competition from domestic and international players may affect market share.

- Execution Risks: Delays in project execution or order fulfillment could impact financial performance.

Conclusion: Zen Technologies Share Price Target 2025 to 2030

Zen Technologies is not just a company; it is a critical player in India’s journey toward self-reliance in defense. With a strong financial foundation, innovative product portfolio, and government support, the company is poised for sustained growth. The projected share price targets indicate significant upside potential, making it an attractive choice for long-term investors.

If you’re looking to invest in a company at the intersection of technology and national security, Zen Technologies might just be the opportunity you’ve been waiting for. As always, conduct thorough research and consult financial advisors before making investment decisions.