Sturdy Industries Ltd Share Price Target 2025 to 2030: Sturdy Industries Ltd, a prominent name in the industrial and infrastructure sector, has captured investors’ attention due to its diverse product portfolio and growth potential. This article provides a detailed analysis of the company’s financial standing, market prospects, and projected share price targets for 2025 to 2030. For long-term investors, this is your ultimate guide to understanding whether Sturdy Industries can be a winning bet for your portfolio.

Current Financial Snapshot

As of today, December 28, 2024, the stock price of Sturdy Industries Ltd stands at ₹0.38. The following table highlights the company’s key financial metrics:

| Metric | Value |

|---|---|

| Current Share Price | ₹0.38 |

| Market Capitalization | ₹5.75 crore |

| 52-Week High/Low | ₹0.69 / ₹0.37 |

| Book Value | ₹-5.63 |

| Return on Equity (ROE) | -11.5% |

| Debt-to-Equity Ratio | 0.68 |

| Dividend Yield | 0% |

Business Overview

Sturdy Industries Ltd is known for its wide array of industrial products, catering to sectors such as power, irrigation, and construction. Here are some of its flagship offerings:

- Aluminium Composite Panels (ACP): Used in architectural projects.

- Conductors & Cables: Essential for power transmission.

- Sprinkler & Drip Irrigation Systems: Boosting agricultural efficiency.

- Plastic Water Storage Tanks & HDPE Pipes: Integral to infrastructure and daily use.

This diversification has helped the company maintain relevance in multiple sectors, though challenges persist due to stiff competition and financial health concerns.

Share Price Performance Overview

Over the last six months, Sturdy Industries’ stock has declined by 22.45%, raising concerns among some investors. However, long-term growth opportunities remain, driven by its product diversification and potential market expansion.

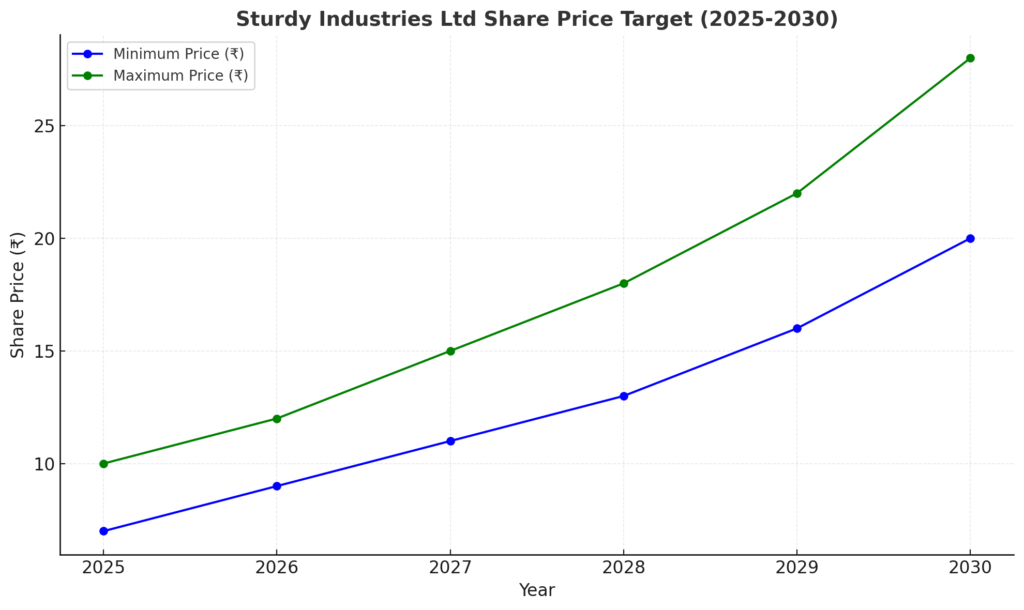

Projected Share Price Targets (2025 to 2030)

To provide clarity for investors, here are the detailed projections for Sturdy Industries Ltd’s share price for the next six years:

| Year | Minimum Price (₹) | Maximum Price (₹) |

| 2025 | ₹1.10 | ₹1.90 |

| 2026 | ₹2.50 | ₹3.80 |

| 2027 | ₹4.50 | ₹6.30 |

| 2028 | ₹6.80 | ₹9.20 |

| 2029 | ₹8.50 | ₹11.70 |

| 2030 | ₹9.90 | ₹12.50 |

Graphical Representation

Below is a graph depicting the projected share price growth trajectory for Sturdy Industries Ltd from 2025 to 2030:

Growth Catalysts

Diverse Product Portfolio: The company caters to various industries, reducing dependency on a single revenue stream.

Expansion Potential: By entering new markets and enhancing its customer base, the company can achieve higher profitability.

Sustainability Trends: With growing demand for sustainable and efficient industrial solutions, Sturdy Industries’ irrigation systems and recyclable ACP products are well-positioned.

Government Schemes: Participation in infrastructure development initiatives like “Make in India” and “Smart Cities” could boost revenues significantly.

Challenges and Risks

Despite its strengths, Sturdy Industries faces significant challenges:

Financial Health: The company’s negative book value and declining ROE indicate that it must address debt and improve operational efficiency.

Stiff Competition: Operating in competitive sectors, Sturdy Industries needs to consistently innovate to maintain its edge.

Market Volatility: Fluctuations in commodity prices and demand could adversely impact the company’s revenues.

Conclusion: Sturdy Industries Ltd Share Price Target 2025 to 2030

Sturdy Industries Ltd presents a balanced opportunity for investors who can withstand short-term volatility in favor of long-term growth. The projected share price targets from 2025 to 2030 reflect significant upside potential. However, challenges like financial instability and competition necessitate cautious optimism. Investors should closely monitor the company’s financials and market conditions while seeking advice from financial experts before making decisions.