Prismx Global Ventures Ltd Share Price Target 2025 to 2030: Prismx Global Ventures Ltd, a penny stock with a presence in financial consultancy and event management, has been attracting attention from retail investors looking for high-risk, high-reward opportunities. As of December 2024, the company’s share price stands at ₹1.05, reflecting significant volatility and investor interest. With growing curiosity about the stock’s performance trajectory, we delve into its potential share price targets from 2025 to 2030 based on current financial data, industry trends, and projected growth.

Financial Snapshot

As of the latest data, here is the financial performance of Prismx Global Ventures Ltd:

| Metric | Value |

|---|---|

| Current Share Price | ₹1.05 |

| Market Capitalization | ₹46.1 Crores |

| 52-Week High/Low | ₹1.77 / ₹0.88 |

| Book Value | ₹2.29 |

| P/E Ratio (TTM) | 17.6 |

| ROCE | -15.5% |

| ROE | -16.5% |

These numbers indicate that while the company is trading below its book value, it faces significant challenges in profitability and operational efficiency.

Business Overview

Prismx Global Ventures Ltd operates in two primary domains:

- Financial Consultancy Services: Offering advisory services to businesses and individuals.

- Sports and Entertainment: Organizing events and managing sports-related infrastructure.

The company’s dual focus on finance and entertainment positions it in unique sectors but also exposes it to high levels of competition and market uncertainty.

Share Price Trends and Historical Performance

Prismx Global Ventures Ltd has shown notable fluctuations over the past year:

- 1 Week: -2.54%

- 1 Month: +10.58%

- 3 Months: -11.54%

- 1 Year: -34.29%

These trends reveal a volatile performance, reflective of broader market uncertainties and company-specific challenges.

Projected Share Price Targets for 2025 to 2030

Based on current financial metrics, market sentiment, and industry forecasts, here are the estimated share price targets for Prismx Global Ventures Ltd:

| Year | Minimum Price (₹) | Maximum Price (₹) |

| 2025 | ₹0.80 | ₹1.20 |

| 2026 | ₹0.70 | ₹1.10 |

| 2027 | ₹0.60 | ₹1.00 |

| 2028 | ₹0.50 | ₹0.90 |

| 2029 | ₹0.40 | ₹0.80 |

| 2030 | ₹0.30 | ₹0.70 |

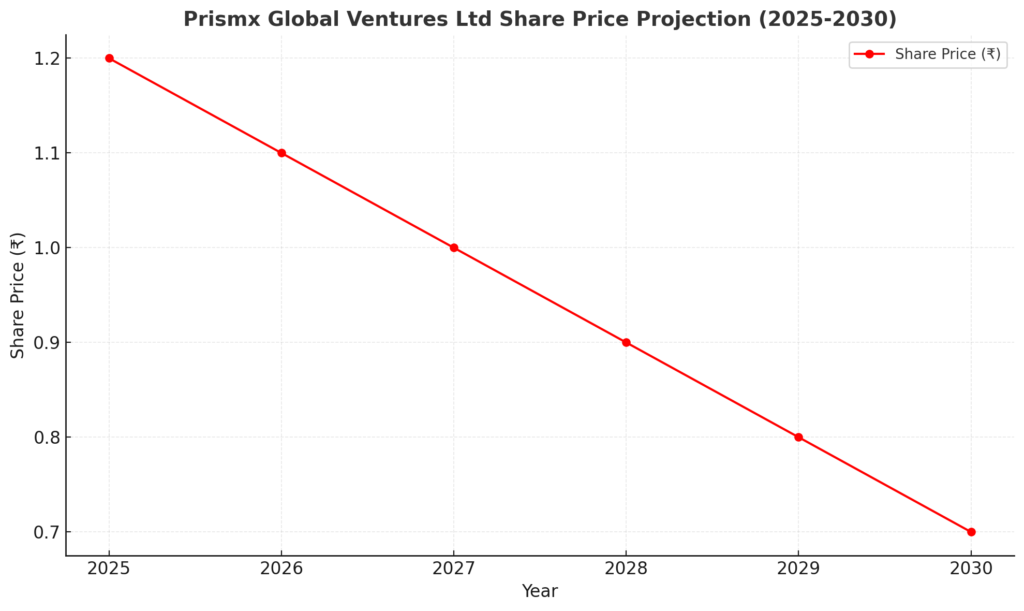

Graphical Representation

Below is a graphical representation of Prismx Global Ventures Ltd’s projected share price growth from 2025 to 2030:

The graph illustrates a gradual decline, starting from ₹1.20 in 2025 and reaching ₹0.70 in 2030. This downward trend reflects consistent challenges in maintaining profitability and market growth.

Opportunities and Risks

Opportunities

- Penny Stock Potential: With a low entry price, the stock appeals to investors looking for exponential returns.

- Sector Diversification: Operating in finance and entertainment provides potential growth avenues if managed effectively.

- Undervalued Nature: Trading below book value suggests possible upside if profitability improves.

Risks

- Negative Profitability: ROCE and ROE figures indicate financial struggles.

- Market Volatility: High fluctuations in share price increase investment risk.

- Competition: Intense competition in consultancy and entertainment limits growth potential.

Conclusion: Prismx Global Ventures Ltd Share Price Target 2025 to 2030

Prismx Global Ventures Ltd presents a high-risk, high-reward investment opportunity for those willing to navigate market uncertainties. While its operations in finance and entertainment offer potential, negative profitability and declining price projections highlight significant risks. Investors should exercise caution and base decisions on comprehensive research and financial advice.