Siti Networks Ltd Share Price Target 2025 to 2030: Siti Networks Ltd., a key player in India’s digital television and broadband sector, has witnessed several ups and downs over the years. But how does its future look from 2025 to 2030? In this detailed article, we will analyze the financial health, market challenges, and projected share prices for Siti Networks Ltd., supported by data, insights, and a graphical representation.

Financial Snapshot of Siti Networks Ltd.

Here’s the current financial overview of Siti Networks Ltd. as of December 2024:

| Metric | Value |

|---|---|

| Current Share Price | ₹0.84 |

| Market Capitalization | ₹47.85 Crore |

| Debt-to-Equity Ratio | -0.80 |

| Net Worth | -₹933.14 Crore |

| Current Ratio | 0.31 (Low liquidity) |

| 52-Week High/Low | ₹1.40 / ₹0.65 |

The data reveals the company’s ongoing struggles with mounting debt and a negative net worth, painting a challenging picture for investors.

Projected Share Price Targets: 2025 to 2030

Based on financial trends and market conditions, here are the projected share prices for Siti Networks over the next six years:

| Year | Projected Price (₹) | Growth/Decline |

|---|---|---|

| 2025 | ₹0.75 | -10% |

| 2026 | ₹0.70 | -7% |

| 2027 | ₹0.65 | -7% |

| 2028 | ₹0.60 | -8% |

| 2029 | ₹0.55 | -8% |

| 2030 | ₹0.50 | -9% |

The consistent downward trajectory highlights the company’s struggle to maintain profitability amidst rising competition and operational challenges.

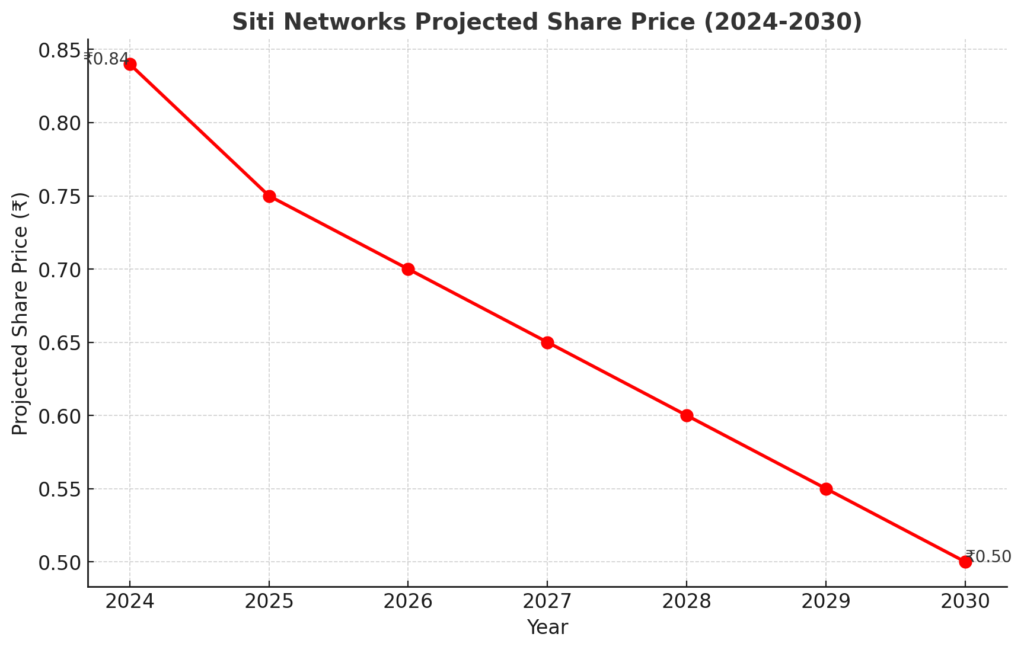

Graphical Representation

Below is a graphical representation of Siti Networks’ projected share price trajectory from 2025 to 2030:

The graph shows a gradual decline, starting from ₹0.84 in 2024 and reaching ₹0.50 in 2030.

Factors Contributing to Price Trends

- High Debt Levels:

Siti Networks’ debt-to-equity ratio of -0.80 highlights excessive liabilities, which limit the company’s ability to fund growth. - Market Competition:

The digital entertainment sector in India is dominated by giants like Tata Play, Airtel, and Jio, reducing Siti Networks’ market share. - Regulatory Impact:

Frequent changes in regulatory frameworks for broadcasting and broadband services could increase operational costs, further squeezing margins. - Technological Challenges:

As consumer preferences shift toward streaming platforms, traditional cable TV providers face declining revenue streams.

Is There a Ray of Hope for Investors?

While the projections paint a grim picture, Siti Networks can bounce back if it:

- Reduces Debt: The company needs to focus on reducing its liabilities to restore financial stability.

- Diversifies Revenue Streams: A pivot toward digital streaming or internet services could help mitigate losses in the cable TV segment.

- Strengthens Customer Retention: Offering competitive pricing and better services could regain lost subscribers.

Should You Invest in Siti Networks?

Investing in Siti Networks comes with significant risks. Here’s what investors should consider:

- High Risk: The company’s financial health makes it a speculative investment.

- Potential Recovery: If the management introduces turnaround strategies, there’s a possibility of recovery in the long term.

- Diversify Portfolio: Investors should not solely rely on Siti Networks and must diversify their portfolio for safety.

Strategic Considerations for Investors

Investors should approach Siti Networks with caution, considering the following:

- Risk Assessment: Evaluate the potential risks associated with the company’s financial health and market position.

- Market Analysis: Stay informed about industry trends and competitive dynamics that could influence the company’s performance.

- Diversification: Consider diversifying investments to mitigate potential losses from underperforming stocks.

Conclusion

Siti Networks faces daunting challenges in maintaining profitability and market share. With a projected share price decline from ₹0.84 in 2024 to ₹0.50 in 2030, the road ahead looks challenging. However, with strategic changes, the company could surprise investors with better-than-expected results.