GV Films Ltd Share Price Target 2025 to 2030: GV Films Ltd, a stalwart in the Indian entertainment industry, has been a significant player in film production and distribution since its inception in 1989. As of December 2024, the company’s share price stands at ₹0.73, reflecting its current market position. Investors are keenly observing this stock, anticipating its performance trajectory from 2025 to 2030.

Current Financial Snapshot

Here is an overview of GV Films Ltd’s financial metrics as of December 2024:

| Metric | Value |

|---|---|

| Current Share Price | ₹0.73 |

| Market Capitalization | ₹136 Crores |

| 52-Week High/Low | ₹1.20 / ₹0.61 |

| Book Value | ₹0.61 |

| Price-to-Earnings (P/E) | N/A |

| Debt-to-Equity Ratio | N/A |

| Return on Equity (ROE) | -2.08% |

| Dividend Yield | 0.00% |

These figures indicate that while the company is trading above its book value, it has a negative ROE, suggesting challenges in profitability.

Business Overview

GV Films Ltd operates primarily in the following segments:

- Film Production: Creating feature films across various genres.

- Film Distribution: Distributing films to theaters and digital platforms.

- Digital Content: Venturing into digital media to adapt to changing consumer preferences.

The company’s adaptability to digital trends and its legacy in film production position it uniquely in the evolving entertainment landscape.

Share Price Performance

Over the past year, GV Films Ltd’s stock has shown the following movements:

- 1 Month: Increased by 6.02%

- 3 Months: Increased by 11.39%

- 6 Months: Increased by 8.64%

While the stock remains below ₹1, these increments indicate a gradual positive trend.

Projected Share Price Targets for 2025 to 2030

Based on current market trends, industry forecasts, and financial analyses, here are the estimated share price targets for GV Films Ltd:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹0.80 | ₹1.00 |

| 2026 | ₹1.10 | ₹1.40 |

| 2027 | ₹1.50 | ₹1.90 |

| 2028 | ₹2.00 | ₹2.50 |

| 2029 | ₹2.60 | ₹3.20 |

| 2030 | ₹3.30 | ₹4.00 |

These projections suggest a steady appreciation in share value over the next six years.

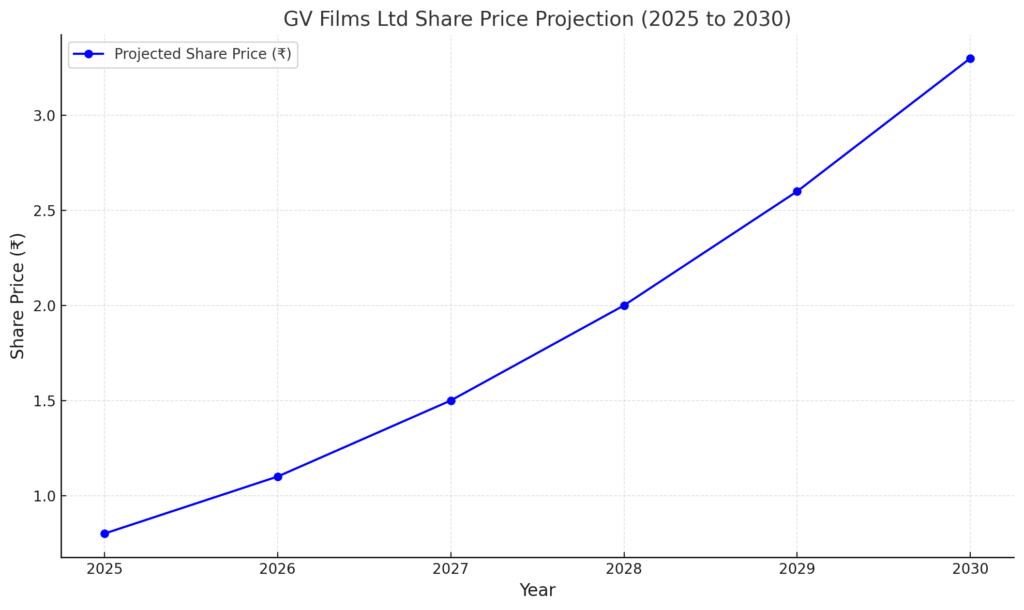

Graphical Representation

Below is a graphical representation of GV Films Ltd’s projected share price growth from 2025 to 2030:

The graph illustrates an upward trend, starting from ₹0.80 in 2025 and reaching ₹4.00 in 2030, indicating consistent growth.

Key Growth Catalysts

- Digital Transformation: Embracing digital platforms to distribute content, catering to the growing online audience.

- Content Diversification: Expanding the portfolio to include various genres and regional languages.

- Strategic Partnerships: Collaborating with OTT platforms and other media houses to enhance reach.

- Industry Growth: The Indian entertainment industry is projected to grow at a CAGR of 10%, providing a favorable environment for GV Films Ltd.

Potential Risks

- Negative Profitability: A negative ROE of -2.08% raises concerns about the company’s financial health.

- High Competition: The entertainment sector is highly competitive, with numerous players vying for market share.

- Market Volatility: Changes in consumer preferences and economic conditions can impact performance.

Conclusion: GV Films Ltd Share Price Target 2025 to 2030

GV Films Ltd presents a compelling opportunity for investors interested in the entertainment sector. Its efforts in digital transformation and content diversification, coupled with the industry’s growth prospects, suggest potential for significant returns by 2030. However, investors should remain cautious of the company’s current profitability challenges and the competitive landscape. Continuous monitoring of financial performance and industry trends is recommended for making informed investment decisions.