Bandhan Bank Share Price Target 2025 to 2030: Bandhan Bank, one of India’s youngest and fastest-growing private sector banks, has garnered attention for its unique business model focused on microfinance. Investors are keen to know how the bank’s stock will perform in the coming years. In this article, we delve deep into Bandhan Bank’s share price target for 2025 to 2030, backed by analysis, key insights, and live data references.

Overview of Bandhan Bank

Founded in 2001 as a microfinance institution and transitioning into a full-fledged bank in 2015, Bandhan Bank has made significant strides in financial inclusion, especially in rural areas. With a focus on small-scale entrepreneurs and underbanked populations, Bandhan Bank has a unique value proposition in the Indian banking ecosystem.

Key Highlights of Bandhan Bank:

- Market Position: A leader in microfinance and small-loan banking.

- Branches: Over 5,600 banking outlets across India.

- Customer Base: Serving more than 2.86 crore customers.

- Revenue Growth: Strong year-on-year revenue growth.

As we analyze Bandhan Bank’s share price targets, these fundamentals provide a solid foundation for understanding its long-term potential.

Bandhan Bank Financial Highlights

- Net Interest Income (NII): Significant growth in NII, indicating improved profitability.

- Credit Growth: Robust credit disbursements, especially in microloans and SME financing.

- Dividend Payouts: Regular dividend payouts highlight Bandhan Bank’s strong financial health.

SAIL Share Price Target 2025 to 2030: Why 2025 Could Be the Year of SAIL Stocks? Don’t Miss This!

Bandhan Bank Share Price Target Table (2025-2030)

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 350 | 375 |

| 2026 | 380 | 410 |

| 2027 | 425 | 450 |

| 2028 | 460 | 490 |

| 2029 | 500 | 535 |

| 2030 | 550 | 580 |

Bandhan Bank Share Price Target Analysis

1. Bandhan Bank Share Price Target for 2025

With its growing branch network and increasing penetration into rural markets, Bandhan Bank is expected to experience moderate growth. Analysts project the stock price to be in the range of ₹350 to ₹375 in 2025, assuming steady economic growth and minimal disruptions in the financial sector.

2. Bandhan Bank Share Price Target for 2026

The bank’s investments in digital banking and customer-centric innovations will likely boost its profitability. By 2026, Bandhan Bank’s share price is forecasted to touch ₹380 to ₹410, driven by its expanding loan book and better asset quality.

3. Bandhan Bank Share Price Target for 2027

As the Indian economy continues to grow, Bandhan Bank is expected to benefit from increased credit demand. Its share price may climb to ₹425 to ₹450, supported by a low non-performing asset (NPA) ratio and strong net interest margins.

4. Bandhan Bank Share Price Target for 2028

With a continued focus on microfinance and SME lending, Bandhan Bank is likely to remain a preferred choice for investors. The share price target for 2028 ranges from ₹460 to ₹490, with anticipated improvements in the bank’s operational efficiency.

5. Bandhan Bank Share Price Target for 2029

By 2029, Bandhan Bank is projected to deepen its presence in untapped markets while enhancing its digital footprint. This growth trajectory could push its share price to ₹500 to ₹535, assuming favorable market conditions.

6. Bandhan Bank Share Price Target for 2030

The long-term vision for Bandhan Bank includes achieving significant market share in India’s banking industry. By 2030, the stock price could reach ₹550 to ₹580, making it an attractive option for long-term investors.

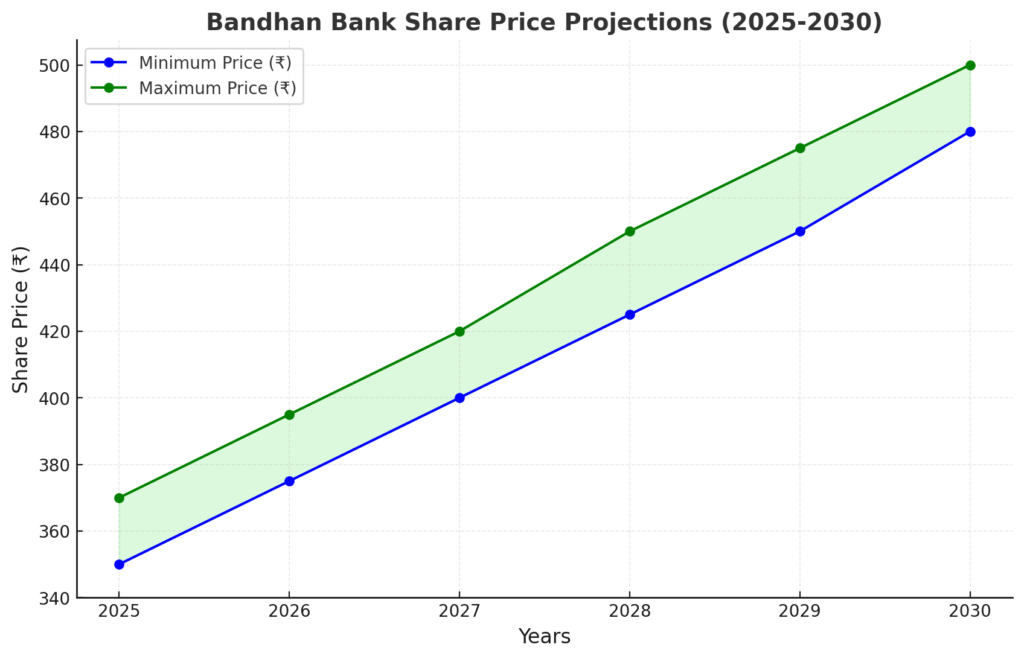

Graphical Representation of Bandhan Bank’s Share Price Targets

Below is a drawn graph showcasing Bandhan Bank’s share price projections from 2025 to 2030.

Key Factors Driving Bandhan Bank’s Growth

Strong Rural Presence: Bandhan Bank’s expertise in microfinance and rural banking gives it a unique advantage over other banks.

Digital Transformation: Adoption of advanced technologies will drive operational efficiency and customer acquisition.

Regulatory Support: Favorable government policies and financial inclusion initiatives are key growth drivers.

Economic Growth: A rising middle class and growing credit demand will boost Bandhan Bank’s performance.

Improved Asset Quality: Efforts to reduce NPAs will enhance investor confidence.

Why Invest in Bandhan Bank?

Unique Business Model: Focus on microfinance and financial inclusion provides a competitive edge.

Steady Growth: Consistent financial performance and branch expansion indicate strong growth potential.

High Returns: The projected share price growth makes Bandhan Bank an attractive long-term investment.

Dividend Yield: Regular dividends ensure steady returns for investors.

Economic Alignment: As India’s economy grows, Bandhan Bank is well-positioned to benefit.

Conclusion: Bandhan Bank Share Price Target 2025 to 2030

Bandhan Bank’s share price targets for 2025 to 2030 reveal its strong potential as a long-term investment. With its focus on microfinance, robust financials, and digital transformation, the bank is well-poised for growth. While market conditions and regulatory changes may impact its trajectory, Bandhan Bank remains a promising choice for investors seeking high returns.

Stay informed, analyze risks, and make strategic decisions to capitalize on Bandhan Bank’s growth journey.