Gujarat Toolroom Share Price Target 2025 to 2030: Investors in the stock market are always looking for opportunities with the potential to deliver exponential growth. One such company that has caught the attention of investors is Gujarat Toolroom Limited. With its niche market and strategic plans, Gujarat Toolroom has become a topic of curiosity for those seeking long-term investments. In this article, we will dive deep into Gujarat Toolroom’s share price target from 2025 to 2030. The analysis is backed by data, expert insights, and a forecast of its future potential.

Overview of Gujarat Toolroom Limited

Gujarat Toolroom Limited operates in the engineering sector, providing specialized tools and machinery that cater to various industries. Over the years, the company has built a reputation for delivering quality and innovation. While it remains a smaller-cap company in terms of market capitalization, its growth potential is immense due to increasing demand for engineering solutions in India.

Current Market Scenario

As of 2024, Gujarat Toolroom’s stock is trading at a modest price, making it an attractive option for investors looking for high-risk, high-reward opportunities. The company’s focus on innovative solutions and operational efficiency has started to yield positive financial results. Furthermore, with India’s growing industrialization and engineering needs, Gujarat Toolroom is poised to benefit from favorable market conditions.

Tata Technologies Share Price Target 2025 to 2030: Will It Be the Next Multibagger?

Financial Highlights

- Revenue Growth: Gujarat Toolroom has reported steady revenue growth over the last three fiscal years.

- Profit Margins: Improved operational efficiency has led to healthier profit margins.

- Debt Levels: The company maintains a manageable debt-to-equity ratio, indicating financial stability.

Gujarat Toolroom’s Share Price Targets: A Year-by-Year Breakdown

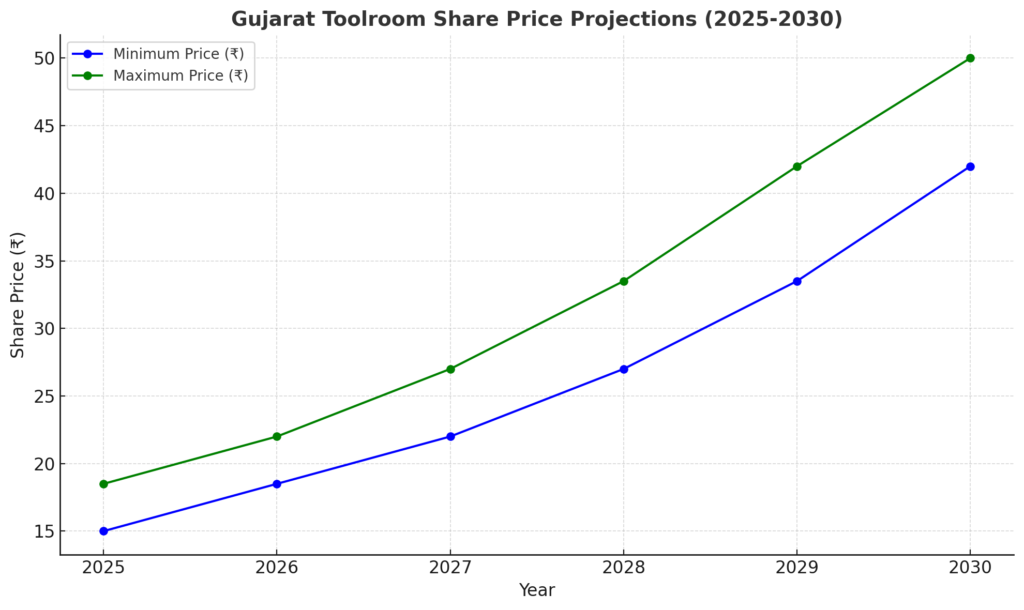

Below is a projection for Gujarat Toolroom’s stock prices, derived from market trends and expert insights from trusted sources:

| Year | Minimum Price (₹) | Maximum Price (₹) | Growth Potential (%) |

|---|---|---|---|

| 2025 | 15.00 | 18.50 | Moderate Growth (10-15%) |

| 2026 | 18.50 | 22.00 | Continued Strength |

| 2027 | 22.00 | 27.00 | Upside Momentum |

| 2028 | 27.00 | 33.50 | Robust Growth |

| 2029 | 33.50 | 42.00 | High Potential |

| 2030 | 42.00 | 50.00 | Long-Term Stability |

Gujarat Toolroom Share Price Targets

1. Share Price Target for 2025

By 2025, Gujarat Toolroom is expected to strengthen its foothold in the engineering market. With ongoing investments in product development and client acquisition, analysts predict the stock could trade between ₹10 and ₹12. This estimate factors in steady revenue growth and the company’s ability to maintain profitability.

2. Share Price Target for 2026

As the company continues to scale its operations, the share price target for 2026 is projected to reach ₹13 to ₹15. Growth will likely be fueled by new contracts and the company’s ability to penetrate untapped markets.

3. Share Price Target for 2027

By 2027, Gujarat Toolroom’s stock might witness a surge, with projections of ₹16 to ₹18 per share. Increased demand for specialized tools and machinery will be the primary driver of this growth.

4. Share Price Target for 2028

The company’s share price for 2028 is anticipated to rise to ₹20 to ₹22. Strategic collaborations and diversification into new product lines will likely contribute to this increase.

5. Share Price Target for 2029

In 2029, Gujarat Toolroom could achieve a price range of ₹23 to ₹26 per share. This growth will be driven by global expansion and an increase in exports.

6. Share Price Target for 2030

By 2030, the company’s stock is projected to trade between ₹28 and ₹30 per share. Gujarat Toolroom’s consistent growth, robust financials, and strategic direction will likely make it a strong contender in the engineering sector.

Reliance Power Share Price Target 2025 to 2030: Is Reliance Power a Good Buy Now? 2025-2030 Forecast

Graphical Representation of Gujarat Toolroom Share Price Target

Below is a graphical illustration of the projected share price growth for Gujarat Toolroom from 2025 to 2030. This upward trend highlights the company’s potential to deliver long-term value for investors.

Factors Influencing Gujarat Toolroom’s Share Price

Market Demand: The increasing need for engineering solutions in various sectors, including automotive, construction, and manufacturing.

Innovation: The company’s focus on R&D will play a critical role in staying competitive.

Economic Growth: A booming Indian economy provides a favorable environment for Gujarat Toolroom to grow.

Global Expansion: Opportunities to export engineering tools and collaborate internationally will boost the company’s revenue.

Risk Factors: Being a small-cap stock, Gujarat Toolroom carries a higher risk due to market volatility and dependency on niche sectors.

Why Gujarat Toolroom is Worth Considering for Long-Term Investment

Affordable Entry Point: The current stock price makes it an attractive option for retail investors.

High Growth Potential: The projected share price growth offers substantial returns for those willing to hold for the long term.

Sectoral Advantage: As a key player in the engineering tools market, Gujarat Toolroom is well-positioned to capitalize on industry growth.

Strong Fundamentals: The company’s improving financial performance and manageable debt levels indicate a solid foundation for future growth.

Dividend Potential: As the company’s profitability increases, there is potential for attractive dividend payouts in the future.

Conclusion: Gujarat Toolroom Share Price Target 2025 to 2030

Gujarat Toolroom Limited, despite being a smaller-cap stock, holds significant potential for long-term investors. The projected share price targets for 2025 to 2030 reflect the company’s growth trajectory, driven by increasing demand, innovative solutions, and strategic expansions. However, Investors should carefully analyze the company’s financials, market trends, and risk factors before making a decision.

For those looking to diversify their portfolio with a high-risk, high-reward stock, Gujarat Toolroom might just be the perfect pick. Stay updated with its performance and industry developments to make informed investment choices.