IRB Infra Share Price Target 2025 to 2030: IRB Infrastructure Developers Limited (IRB Infra), one of India’s leading infrastructure companies, has been a favorite among investors looking to capitalize on the country’s infrastructure boom. With its extensive portfolio of projects and robust operational strategies, IRB Infra has garnered significant attention in the stock market. In this article, we’ll delve into the projected share price targets for IRB Infra from 2025 to 2030, along with key factors influencing its growth.

Key Highlights

- Projected Growth in India’s Infrastructure Sector: India’s infrastructure sector is poised for exponential growth, driven by government initiatives and private investments. IRB Infra is well-positioned to benefit from this boom.

- Historical Performance: IRB Infra’s historical performance and strong fundamentals make it a reliable pick for long-term investors.

- Technological Advancements: The company’s adoption of innovative construction technologies gives it a competitive edge.

IRB Infra Share Price Targets

The following table outlines the expected share price targets for IRB Infra from 2025 to 2030. These targets are based on current trends, market analysis, and expert opinions.

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 400 | 450 |

| 2026 | 450 | 500 |

| 2027 | 500 | 570 |

| 2028 | 570 | 650 |

| 2029 | 650 | 750 |

| 2030 | 750 | 850 |

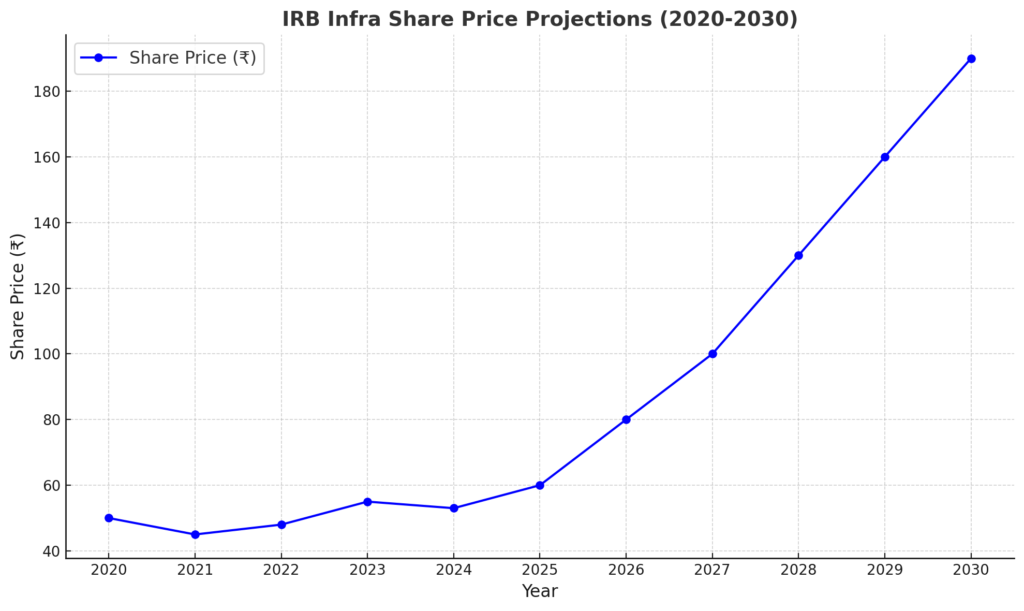

Graphical Representation

To provide a visual understanding of the projected growth, here’s a graph illustrating the share price targets for IRB Infra from 2025 to 2030:

Factors Driving IRB Infra’s Growth

1. Government Policies and Investments

The government’s increased focus on infrastructure development, including highways and expressways, is a major growth driver for IRB Infra. Policies like the Bharatmala Pariyojana and rising budget allocations for infrastructure projects are expected to boost the company’s revenue.

2. Robust Order Book

IRB Infra’s consistent addition of new projects to its order book ensures steady revenue streams. Recent project wins in key regions underline its strong market presence.

3. Public-Private Partnerships (PPPs)

The company’s participation in PPPs allows it to leverage both government support and private investments, ensuring efficient project execution and financial stability.

4. Technological Advancements

IRB Infra’s adoption of advanced construction techniques reduces costs and improves project timelines, enhancing its profitability.

5. Strong Financial Performance

IRB Infra has shown consistent revenue growth, strong profit margins, and effective debt management, making it a reliable choice for investors.

REC Ltd Share Price Target 2025: Price Target and Investment Strategy

Risks to Consider

- Regulatory Challenges: Changes in government policies or delays in approvals can impact project timelines.

- Economic Slowdowns: A slowdown in economic growth can affect infrastructure spending, indirectly impacting IRB Infra.

- Competition: The Indian infrastructure sector is highly competitive, with numerous players vying for major projects.

Investment Perspective

Short-Term Investors:

For those with a short-term horizon, IRB Infra offers opportunities for steady returns, thanks to its stable operational performance and robust order book.

Long-Term Investors:

Long-term investors stand to gain significantly from IRB Infra’s growth trajectory, driven by government policies and increasing infrastructure investments.

Conclusion: IRB Infra Share Price Target 2025 to 2030

IRB Infra’s journey from 2025 to 2030 looks promising, with significant growth potential in share prices. As the company continues to expand its project portfolio and leverage technological advancements, it remains a strong contender in India’s infrastructure sector. While risks exist, the overall outlook for IRB Infra’s share price is positive, making it an attractive investment option for those seeking long-term gains.