IREDA Share Price Target 2025 to 2030: As we step into an era defined by sustainability and green energy, the Indian Renewable Energy Development Agency (IREDA) stands as a cornerstone of India’s ambitious renewable energy revolution.

For investors looking to align their portfolios with future-focused, environmentally conscious opportunities, IREDA offers a promising investment avenue. This article delves deep into IREDA’s share price targets from 2025 to 2030, supported by its financial resilience, government backing, and the growing momentum of renewable energy markets.

Market Overview

India is on a mission to become a global leader in renewable energy. With a goal of achieving 500 GW of renewable energy capacity by 2030, the nation is making monumental strides.

Wind farms, solar parks, bioenergy plants, and small hydroelectric projects are being rapidly developed to meet this ambitious target. At the center of this push is IREDA, playing the dual role of financier and facilitator for these critical projects.

Globally, the renewable energy market is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030, signaling a shift in priorities toward green energy. As the financing backbone of India’s renewable energy sector, IREDA is uniquely positioned to ride this growth wave.

Financial Performance | IREDA Financial Analysis

IREDA’s financial performance in recent years paints a compelling picture for investors. Here’s an overview of the agency’s key financial highlights:

Revenue Growth:

In FY2023, IREDA reported revenue of ₹18.68 billion, a significant 40.69% increase from the previous year’s ₹13.28 billion. This growth reflects the rising demand for renewable energy financing and the agency’s ability to capitalize on the sector’s expansion.

Profitability:

For the quarter ending September 2024, IREDA posted a Profit After Tax (PAT) of ₹387.75 crore, showcasing an impressive year-on-year growth of 36.18%.

Asset Quality:

IREDA has reduced its Net Non-Performing Assets (NPAs) to 1.04% from 1.65% in the previous financial year. This improvement highlights the agency’s effective risk management and financial discipline.

Net Worth:

As of June 2024, IREDA’s net worth stood at ₹9,110.19 crore, reflecting a robust financial foundation and growth potential.

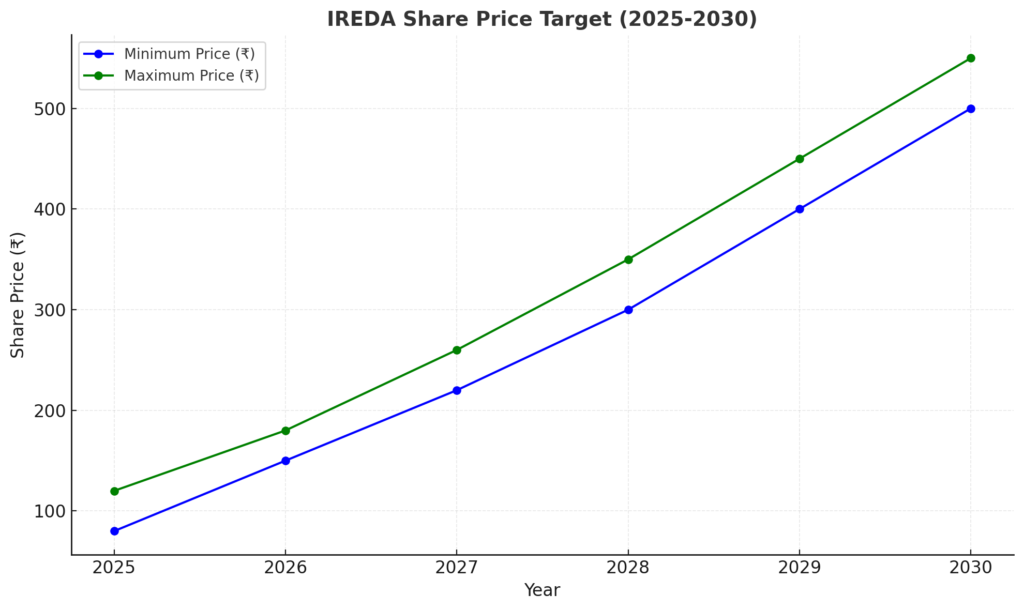

IREDA Share Price Targets: 2025 to 2030

Given its financial trajectory and the renewable energy sector’s bright prospects, here are the projected share price targets for IREDA:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 80 | 120 |

| 2026 | 150 | 180 |

| 2027 | 220 | 260 |

| 2028 | 300 | 350 |

| 2029 | 400 | 450 |

| 2030 | 500 | 550 |

Graphical Representation: IREDA Share Price Targets 2025 to 2030

What Sets IREDA Share Apart?

1. Government Backing

IREDA operates under the Ministry of New and Renewable Energy (MNRE), ensuring strong government support. This backing translates into access to low-interest loans, subsidies, and policy-driven growth opportunities.

2. Diversified Portfolio

The agency funds projects across multiple renewable energy segments, including wind, solar, biomass, and small hydro. This diversification mitigates risk and ensures a steady revenue stream.

3. Consistent Growth

With a proven track record of profitability and continuous improvement in asset quality, IREDA is a stable investment choice.

4. Pioneering Green Initiatives

IREDA is not just financing projects; it is shaping the future of India’s energy landscape. Its focus on sustainable and innovative technologies positions it as a leader in the renewable energy sector.

Risks to Consider

While IREDA’s outlook is overwhelmingly positive, investors should remain mindful of the following risks:

Market Volatility:

Fluctuations in global energy prices and economic conditions can impact the renewable energy sector’s growth trajectory.

Execution Risks:

Delays in project implementation could affect IREDA’s revenue streams and profitability.

Debt Levels:

Although IREDA has shown significant improvement in reducing its NPAs, debt management remains critical to sustaining its growth.

Conclusion: IREDA Share Price Target 2025 to 2030

IREDA is not just a financial institution; it’s a symbol of India’s commitment to a sustainable future. With its strong financials, government support, and pivotal role in renewable energy development, IREDA offers immense growth potential for investors. From a modest share price of ₹80 in 2025 to an ambitious target of ₹550 by 2030, the agency’s projections are a testament to its bright future.

For investors seeking a balance of stability and growth, IREDA represents a golden opportunity. It’s not merely an investment in a company; it’s an investment in a cleaner, greener tomorrow.