IRFC Share Price Target 2024-2030: Indian Railway Finance Corporation (IRFC), the backbone of Indian Railways’ financial operations, has gained significant traction in the stock market.

As a Public Sector Undertaking (PSU), its monopoly in railway financing, consistent dividend payouts, and government backing make it a sought-after investment option. This article delves into IRFC’s share price targets for 2024 to 2030, providing insights into its potential for investors.

IRFC Share Price Target Overview

Here’s a detailed forecast for IRFC’s share price from 2024 to 2030:

| Year | Minimum Price (₹) | Maximum Price (₹) | Average Price (₹) |

|---|---|---|---|

| 2024 | 55 | 65 | 60 |

| 2025 | 75 | 90 | 82 |

| 2026 | 110 | 130 | 120 |

| 2027 | 150 | 175 | 162 |

| 2028 | 200 | 230 | 215 |

| 2029 | 275 | 310 | 293 |

| 2030 | 350 | 400 | 375 |

Factors Driving IRFC’s Share Price Growth

Government Backing:

As a PSU, IRFC enjoys strong government support. India’s growing investment in railway infrastructure, including electrification and modernization, directly boosts IRFC’s revenue.

Dividend Consistency:

IRFC’s regular dividend payouts attract long-term investors. For instance, the interim dividend in November 2023 stood at ₹0.80 per share, demonstrating its commitment to shareholder returns.

Railway Modernization:

Initiatives such as high-speed rail corridors, increased freight traffic, and urban transit development amplify IRFC’s financing demand.

Low Risk:

IRFC’s monopoly in railway financing and its predictable revenue stream make it a low-risk investment compared to peers like REC Ltd. and Power Finance Corporation.

IRFC Share Price Target 2024

In 2024, IRFC’s stock is expected to remain steady due to its consistent operational performance. The anticipated range is ₹55 to ₹65, with an average of ₹60. Government-led projects and rising investor confidence contribute to this stability.

IRFC Share Price Target 2025

The year 2025 is likely to witness accelerated growth as IRFC secures larger financing projects. Projections are as follows:

- Minimum Price: ₹75

- Maximum Price: ₹90

- Average Price: ₹82

The government’s focus on doubling rail freight capacity and electrification will act as key catalysts.

Dividend History of IRFC

IRFC has a commendable dividend record, reinforcing investor confidence. Below is a summary:

| Announcement Date | Ex-Date | Dividend Type | Dividend (₹) |

|---|---|---|---|

| 20-Oct-2023 | 10-Nov-2023 | Interim | 0.80 |

| 25-May-2023 | 15-Sep-2023 | Final | 0.70 |

| 31-Oct-2022 | 17-Nov-2022 | Interim | 0.80 |

Competitors Comparison

Although IRFC faces competition from financial institutions like Power Finance Corporation and REC Ltd., its exclusive focus on railways gives it an edge. Here’s a quick comparison:

| Company | Market Cap (₹ Cr) | P/E Ratio |

|---|---|---|

| IRFC | 46,000+ | 10.5 |

| Power Finance Corp. | 1,38,000+ | 5.8 |

| REC Ltd. | 1,20,000+ | 5.2 |

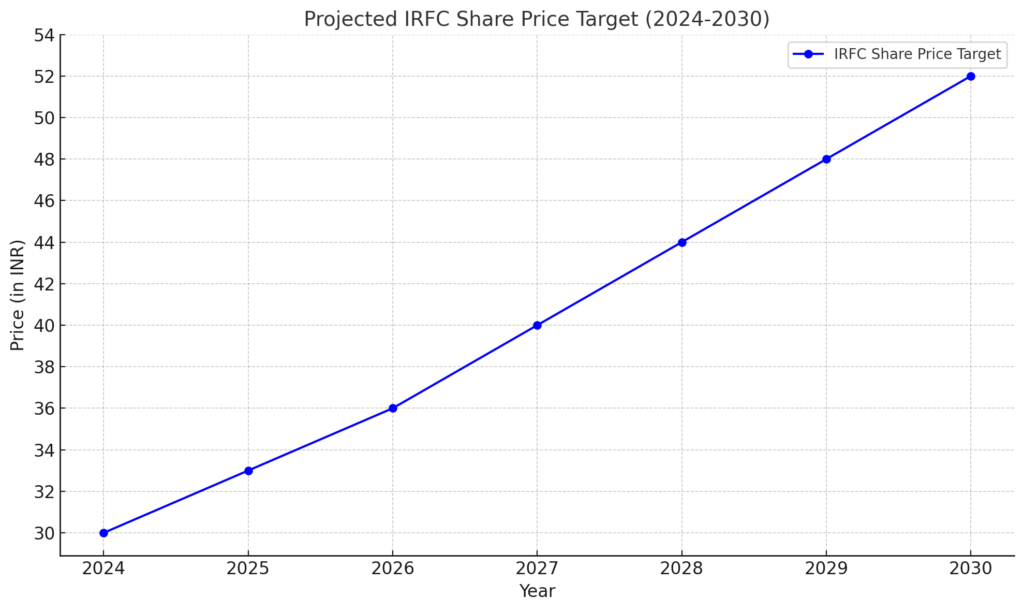

Graphical Representation of Price Trends

Why Invest in IRFC?

Stable Business Model: Monopolistic operations in railway financing.

Dividend Returns: Regular payouts ensuring steady income.

Growth Potential: Expansion plans in rail infrastructure support sustained profitability.

Conclusion: IRFC Share Price Target 2024-2030

IRFC stands out as a promising long-term investment with its stable business model, strong government backing, and consistent returns. Its projected share price targets from 2024 to 2030 underline its growth potential, making it a compelling choice for both conservative and growth-oriented investors.