Motilal Oswal Financial Services Share Price Target 2025 to 2030: Motilal Oswal Financial Services (MOFSL) is a renowned name in India’s financial ecosystem, known for its robust portfolio of services ranging from equity broking and asset management to investment banking and wealth management. As an investor, you might be wondering if MOFSL is the right pick for your portfolio. With this article, we delve deep into MOFSL’s share price targets for 2025 to 2030, offering insights based on its performance, market trends, and growth potential.

Company Overview

MOFSL is a diversified financial services firm in India, offering services such as retail and institutional broking, asset management, wealth management, investment banking, and more. The company has a market capitalization of approximately ₹54,858 crore, a P/E ratio of 16.21, and a return on equity (ROE) of 30.58%.

A Look at Motilal Oswal’s Journey So Far

Motilal Oswal Financial Services has consistently delivered value to its shareholders through strong financial performance and industry-leading services. The company boasts:

- Market Capitalization: Approximately ₹54,858 crore.

- Return on Equity (ROE): 30.58%.

- Price-to-Earnings Ratio (P/E): 16.21.

- 52-Week Range: A low of ₹306 and a high of ₹1,064.

Over the years, MOFSL has demonstrated resilience and adaptability, thriving amid market volatility and emerging as a trusted name in India’s financial sector.

Share Price Performance and Projections

Before jumping into the targets, let’s analyze MOFSL’s recent share price movement. As of December 2024, MOFSL’s stock trades at ₹910.40 on the NSE. With strong fundamentals and a diversified business model, the stock is well-positioned for long-term growth.

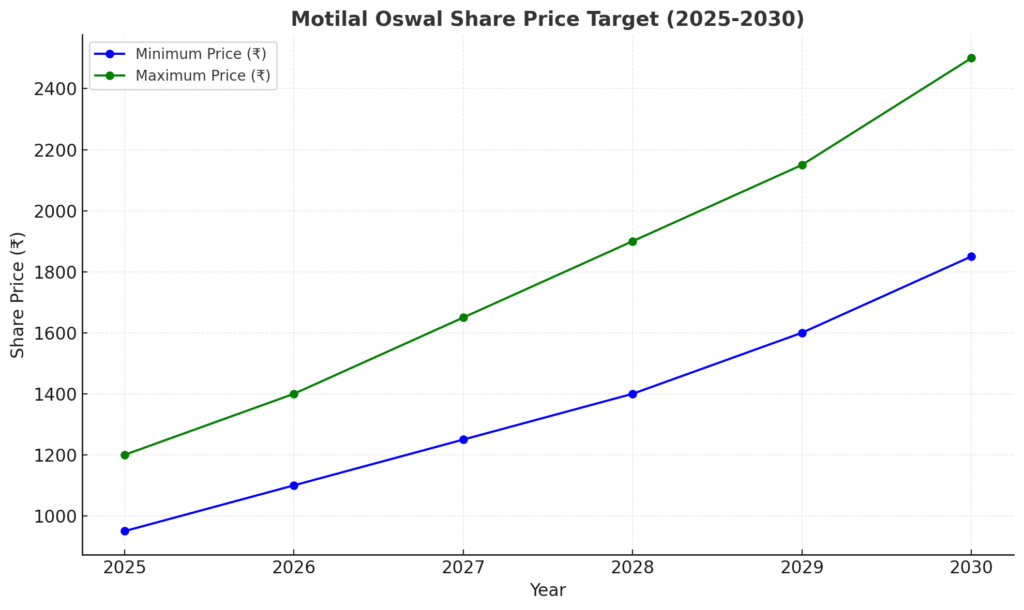

Here are the projected share price targets for the coming years:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 1,000 | 1,100 |

| 2026 | 1,150 | 1,250 |

| 2027 | 1,300 | 1,400 |

| 2028 | 1,400 | 1,500 |

| 2029 | 1,500 | 1,600 |

| 2030 | 1,600 | 1,800 |

Graphical Representation

To make these projections visually appealing and easier to understand, here’s a graph plotting MOFSL’s projected share price growth from 2025 to 2030:

This graph illustrates a steady upward trajectory, reflecting the company’s robust growth potential.

Key Drivers for MOFSL’s Growth

- Diverse Business Model: MOFSL operates across multiple financial verticals, reducing dependency on a single revenue stream. Its asset management and wealth management arms have witnessed remarkable growth.

- Technological Innovations: The company has embraced technology to enhance its offerings, including advanced trading platforms and AI-driven investment advisory.

- India’s Growing Economy: As India’s economy expands, so does the demand for financial services, creating a fertile ground for MOFSL’s continued success.

- Strong Leadership: With seasoned professionals steering the company, MOFSL’s strategic decisions have consistently aligned with market demands.

- Robust Financials: High ROE and ROCE metrics underline the company’s profitability and efficiency, making it a compelling investment choice.

Potential Risks to Consider

While the future looks bright, investors must remain cautious of potential risks, including:

- Market volatility and economic downturns.

- Regulatory changes in the financial services sector.

- Competition from other financial giants in India.

Conclusion: Motilal Oswal Financial Services Share Price Target 2025 to 2030

Motilal Oswal Financial Services stands as a beacon of growth and reliability in India’s financial sector. With promising share price targets for 2025 to 2030, the stock presents an attractive opportunity for long-term investors. However, as with any investment, due diligence and risk assessment are paramount. Consult with a financial advisor to align your investment strategy with your financial goals.