NALCO Share Price Target for 2025 to 2030: National Aluminium Company Limited (NALCO), one of the leading players in the aluminium industry, has consistently attracted investors due to its solid financial performance and strategic expansions. With a stronghold in the metal and mining sector, NALCO’s growth trajectory shows immense promise. This article provides a detailed year-by-year analysis of NALCO’s share price targets from 2025 to 2030, while exploring the factors driving its growth.

Quick Overview

- Company Name: National Aluminium Company Limited (NALCO)

- Sector: Aluminium, Mining, and Power

- Market Cap: ₹39,000 Crores (Approx.)

- PE Ratio: 7.25 (indicative)

- Current Share Price (2024): ₹220

- Promising Growth Areas: Renewable energy, export growth, and domestic expansion.

Market Position

NALCO holds a prestigious position as a Navratna company under the Ministry of Mines, Government of India. The company is one of the largest integrated aluminium producers in the country, with a strong export market. Its cost-efficient operations, substantial bauxite reserves, and focus on renewable energy are key strengths propelling its market presence.

Financial Highlights

NALCO has demonstrated consistent financial growth over the past few years, driven by higher aluminium prices, increased production capacity, and strategic cost-cutting measures. Key highlights include:

- Revenue Growth: A steady increase in revenues with substantial contributions from both domestic and export markets.

- Profit Margins: The company has maintained healthy profit margins, supported by low production costs and vertical integration.

- Debt-Free Status: NALCO operates with minimal debt, ensuring strong financial stability and the ability to invest in future growth opportunities.

SAIL Share Price Target 2025 to 2030: Why 2025 Could Be the Year of SAIL Stocks? Don’t Miss This!

NALCO Share Price Target Table (2025-2030)

| Year | Share Price Target (₹) |

|---|---|

| 2024 | ₹220 |

| 2025 | ₹286 |

| 2026 | ₹360 |

| 2027 | ₹445 |

| 2028 | ₹526 |

| 2029 | ₹603 |

| 2030 | ₹669 |

NALCO Share Price Target Year-by-Year Analysis

2025: ₹286

NALCO’s share price is expected to grow steadily in 2025, driven by higher aluminium demand globally and increased government infrastructure projects in India. Investments in green energy initiatives could also enhance investor confidence.

2026: ₹360

The share price in 2026 is projected to witness a sharp increase as NALCO leverages its robust production capabilities to cater to growing aluminium exports. Expansion into renewable energy projects will act as a catalyst for growth.

2027: ₹445

In 2027, NALCO is likely to achieve higher operational efficiency, resulting in improved margins. The company’s increasing dominance in both domestic and international markets will significantly boost its valuation.

2028: ₹526

The share price in 2028 will reflect NALCO’s strengthened market position. Strategic collaborations and government policies supporting the metal and mining industry will further bolster investor sentiment.

2029: ₹603

By 2029, NALCO’s continued focus on sustainable and innovative operations will drive substantial revenue growth. Global demand for aluminium in industries like electric vehicles and renewable energy will contribute to this price surge.

2030: ₹669

The year 2030 is expected to be a milestone for NALCO, with its share price reaching new heights. By capitalizing on strategic expansions and consistent performance, NALCO could emerge as a market leader in the global aluminium industry.

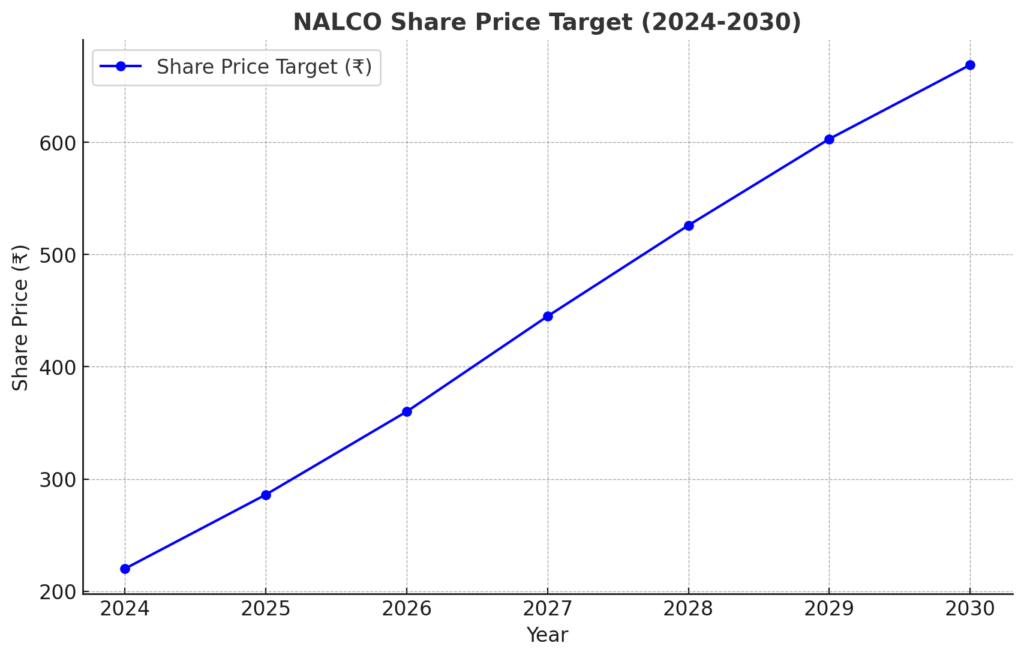

Graphical Representation of Share Price Targets

Below is a graph showcasing NALCO’s projected share price growth trajectory from 2024 to 2030:

Key Factors Influencing Share Price

Global Aluminium Demand: The growing demand for aluminium in industries like electric vehicles, packaging, and construction will fuel NALCO’s growth.

Government Policies: Supportive policies, such as subsidies for renewable energy and infrastructure projects, will positively impact NALCO’s operations.

Vertical Integration: NALCO’s fully integrated business model ensures cost efficiency, boosting profitability.

Renewable Energy Focus: Investments in green energy will not only enhance sustainability but also attract ESG-focused investors.

Export Growth: Increasing exports to key markets will provide significant revenue boosts in the coming years.

Conclusion: NALCO Share Price Target for 2025 to 2030

NALCO stands as a promising investment opportunity in the aluminium sector, with strong fundamentals and growth-oriented strategies. Its share price targets from ₹286 in 2025 to ₹669 in 2030 showcase its potential to deliver exceptional returns for investors. As NALCO continues to capitalize on global trends and strategic initiatives, it could redefine its position as a leader in the global aluminium industry.

For investors looking to invest in the long-term, NALCO’s growth trajectory looks bright and lucrative. However, as with any investment, it is essential to monitor market trends and seek professional advice.