PFC Share Price Target for 2025 to 2030: Power Finance Corporation (PFC) has long been a key player in India’s power and renewable energy sector, garnering the attention of investors looking for stable and profitable investments. This article explores PFC’s projected share price targets for 2025 to 2030, based on its solid market position and financial growth trajectory. Let’s dive into the numbers and understand what the future holds for PFC.

Quick Overview

- Company Name: Power Finance Corporation Limited (PFC)

- Sector: Non-Banking Financial Company (NBFC) – Power Financing

- Established: 1986

- Core Services: Providing financing solutions for power sector infrastructure projects, including renewable energy projects.

- Market Position: PFC is one of the leading financial institutions catering to India’s power and energy sectors, benefiting from government support and the growing demand for clean energy.

Market Position

PFC holds a pivotal role in India’s power sector, with a portfolio that spans traditional and renewable energy projects. The company is the go-to financier for energy infrastructure projects across the country, making it a key beneficiary of India’s push for renewable energy.

Reliance Power Share Price Target 2025 to 2030: Is Reliance Power a Good Buy Now? 2025-2030 Forecast

Financial Highlights

PFC has demonstrated strong financial health with consistent profitability, even amidst market volatility. The company has significantly increased its loan book for renewable energy projects, which will continue to drive its growth. In FY2023, PFC reported a healthy increase in its profit after tax (PAT) and an enhanced credit rating, giving investors a sense of confidence in its future growth.

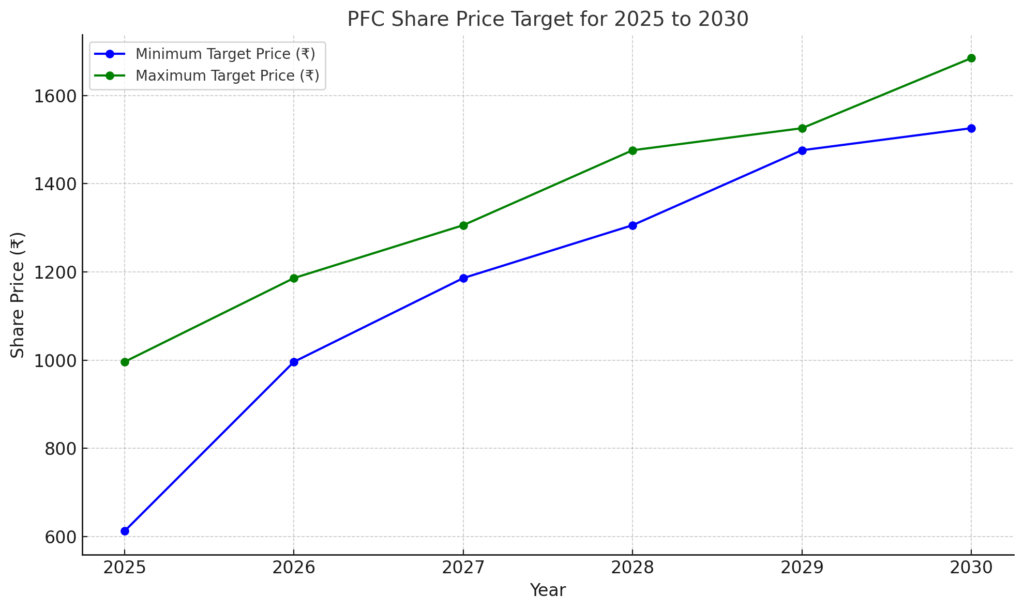

PFC Share Price Target Table (2025-2030)

| Year | Minimum Target Price (₹) | Maximum Target Price (₹) |

|---|---|---|

| 2025 | ₹612 | ₹996 |

| 2026 | ₹996 | ₹1186 |

| 2027 | ₹1186 | ₹1306 |

| 2028 | ₹1306 | ₹1476 |

| 2029 | ₹1476 | ₹1526 |

| 2030 | ₹1526 | ₹1685 |

PFC Share Price Year-by-Year Analysis

2025: Establishing Strong Foundations

As PFC strengthens its renewable energy portfolio and secures more government-backed projects, the stock is likely to see steady growth. The share price could range between ₹612 and ₹996 by 2025, with a focus on capturing market share in the green energy segment.

2026: Expanding Into New Sectors

By 2026, PFC is expected to have expanded its financing across newer energy sectors, such as electric vehicles and battery storage solutions. This will likely push the stock price further upwards, with a target range of ₹996 to ₹1186.

2027: Capitalizing on Government Initiatives

With the government’s commitment to increasing renewable energy capacity, PFC’s stock could experience a sharp rise. Its active participation in financing large-scale energy projects will make the company more attractive to investors, with an expected target of ₹1306 by the end of 2027.

2028: Reaching New Heights

The increased demand for power infrastructure and PFC’s growing influence in financing renewable projects will drive the share price to a higher level. PFC’s stock could touch ₹1476 by 2028 as India accelerates its green energy transition.

2029: Optimized Growth

By 2029, PFC will have strengthened its market position, expanding its reach in both traditional and renewable energy sectors. The share price may settle between ₹1476 and ₹1526, reflecting the positive outlook for the power financing industry.

2030: Industry Leader

With the energy sector continuing to evolve, PFC is likely to emerge as an industry leader in clean energy financing by 2030. The stock may reach ₹1685 as India meets its ambitious energy goals and PFC captures a larger share of the market.

Graphical Representation for PFC Share Price

Here is the graph showing the PFC share price target for the years 2025 to 2030:

Key Factors Influencing PFC’s Share Price

Government’s Renewable Energy Push: The Indian government’s focus on achieving a 500 GW renewable energy target by 2030 will directly benefit companies like PFC, which finance power projects.

Strong Financial Health: PFC’s increasing profitability and strong asset management will likely support steady growth in its stock price.

Public and Private Sector Collaboration: As PFC continues to partner with government bodies and private players for large infrastructure projects, its market position will solidify.

Energy Demand Growth: As India’s energy needs rise, particularly in the renewable energy sector, PFC’s financing will continue to play a crucial role in powering the country’s development.

Conclusion: PFC Share Price Target for 2025 to 2030

Power Finance Corporation (PFC) remains a solid investment option for those looking to tap into India’s growing energy sector. With its strong backing, robust financial health, and pivotal role in financing renewable energy projects, PFC’s share price has the potential to see significant growth from 2025 to 2030. The forecasted price targets reflect both the challenges and opportunities that lie ahead, making PFC an attractive stock for investors focused on long-term growth in the energy and power sector.