RattanIndia Power Share Price Target 2025 to 2030: As India marches toward a new era of energy sufficiency and sustainability, power companies like RattanIndia Power Limited hold the torch for the country’s ambitious journey. For investors, the big question is whether this company, once known for its potential, will finally deliver the explosive growth they’ve been hoping for. In this analysis, we unravel RattanIndia Power’s financial performance, market potential, and share price forecasts for the period between 2025 and 2030—a decade brimming with opportunity and challenges.

About RattanIndia Power

RattanIndia Power Limited is a significant private sector player in India’s thermal power space. The company operates two major power plants, Amravati and Nashik, in Maharashtra, with a total installed capacity of 2,700 MW. For years, the company has battled operational challenges, market fluctuations, and debt—but now, its narrative seems to be shifting.

Current Standing

Share Price: As of December 23, 2024, RattanIndia Power is trading at ₹13.88, which reflects its gradual recovery from turbulent times.

Market Capitalization: At ₹7,309 crore, the company’s value highlights its importance in the Indian power generation ecosystem.

RattanIndia Power Share Price Targets: 2025 to 2030

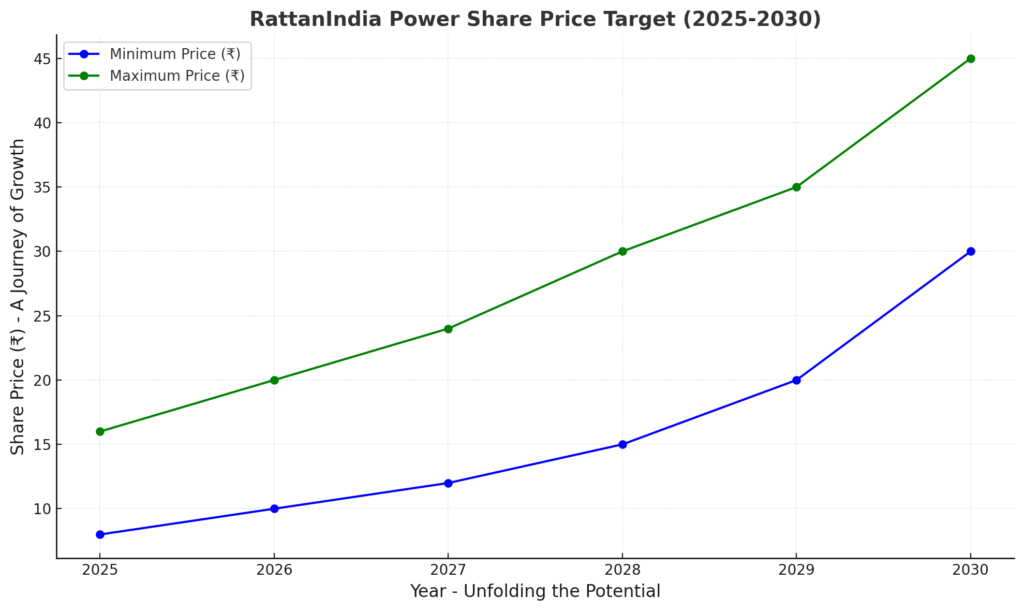

Taking into account the company’s financial stability, market trends, and India’s surging power demand, the projected share price targets are as follows:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹8 | ₹16 |

| 2026 | ₹10 | ₹20 |

| 2027 | ₹12 | ₹24 |

| 2028 | ₹15 | ₹30 |

| 2029 | ₹20 | ₹35 |

| 2030 | ₹30 | ₹45 |

Financial Performance | RattanIndia Power Share Price Target 2025 to 2030

Revenue Growth

RattanIndia Power has displayed encouraging signs of recovery, with consistent improvements in its revenue generation. This growth is attributed to its focus on operational efficiencies, better utilization of capacity, and a favorable power demand scenario in India.

Debt Reduction

Debt has been the Achilles’ heel of many power companies, and RattanIndia Power was no exception. However, the company’s determined efforts to cut down its debt burden have started yielding results, enhancing investor confidence and freeing up resources for growth initiatives.

Improved Asset Quality

Efficient operations and consistent maintenance of power plants have allowed RattanIndia to ensure the quality of its assets. This is a critical factor in maintaining profitability and meeting India’s growing energy needs.

Graphical Representation | RattanIndia Power Share Price Target 2025 to 2030

Here is the graph illustrating the projected growth of RattanIndia Power’s share prices from 2025 to 2030.

Why Invest in RattanIndia Power?

1. Growing Energy Demand

India’s insatiable hunger for energy creates enormous opportunities for power producers. With industrial growth and urbanization on the rise, companies like RattanIndia Power are positioned to meet this demand head-on.

2. Government Support

The Indian government’s pro-energy policies, coupled with subsidies and incentives for infrastructure development, provide a strong tailwind for companies in this sector.

3. Debt Management and Improved Operations

RattanIndia’s efforts to reduce debt and streamline operations have begun to pay off, making it a safer investment option for the long term.

4. Strategic Power Plants

Its two massive plants in Maharashtra are strategically located to cater to some of India’s most industrialized regions, ensuring consistent demand for power.

Risks to Consider

1. Regulatory Changes

While government support is strong today, changes in policies or tariffs could impact the company’s profitability.

2. Intense Competition

India’s power sector is fiercely competitive, with several players vying for market share. RattanIndia must continuously innovate and adapt to maintain relevance.

3. Dependence on Thermal Energy

As the world pivots toward cleaner energy sources, thermal power companies face an existential threat unless they diversify their portfolios.

Conclusion: RattanIndia Power Share Price Target 2025 to 2030

RattanIndia Power Limited has weathered many storms, emerging stronger and more focused. With India’s energy demand poised to soar and the company’s efforts to streamline its financials and operations, there’s reason to believe in its growth story.

By 2025, the stock could see a modest surge to ₹16, but by 2030, there’s potential for it to reach an ambitious ₹45, provided the company capitalizes on its strengths and navigates challenges effectively.

For investors looking for a high-risk, high-reward opportunity in India’s power sector, RattanIndia Power could be a compelling choice. However, due diligence and constant monitoring of the company’s performance are essential before making an investment decision.