Reliance Power Share Price Target 2025 to 2030: Reliance Power has been a prominent player in the Indian power sector, known for its diverse portfolio of thermal, hydro, and solar power projects.

As investors keenly analyze its future potential, the share price target for the years 2025 to 2030 has become a hot topic of discussion.

This article delves into the detailed analysis of Reliance Power’s growth trajectory, financial performance, and potential share price targets for the next decade, helping investors make informed decisions.

Reliance Power: A Brief Overview

Reliance Power, part of the Reliance Group, is one of India’s largest private-sector power generation companies.

Established with a vision to bridge the energy demand-supply gap, the company operates multiple power projects across India and abroad.

With an installed capacity of over 6,000 MW, Reliance Power is a key contributor to India’s energy ecosystem.

In recent years, Reliance Power has been focusing on debt reduction, operational efficiency, and expanding its renewable energy portfolio. These factors could play a pivotal role in driving the company’s stock performance in the coming years.

Key Factors Influencing Reliance Power’s Share Price

Debt Reduction Initiatives

Reliance Power has been actively working on reducing its debt burden, which has been a major concern for investors. Successful debt restructuring could boost investor confidence and positively impact share prices.

Renewable Energy Expansion

With the global shift towards renewable energy, Reliance Power’s focus on solar and wind projects aligns with market trends. This diversification could lead to a more stable revenue stream.

Government Policies

The Indian government’s emphasis on infrastructure development and renewable energy offers significant growth opportunities for companies like Reliance Power.

Operational Efficiency

Improved operational performance and cost management can enhance the company’s profitability, directly influencing its stock valuation.

Market Sentiment

Investor sentiment towards the power sector and macroeconomic conditions will also play a crucial role in determining Reliance Power’s share price.

Reliance Power Share Price Target 2025

Given the company’s ongoing efforts to streamline operations and reduce debt, the share price target for 2025 appears promising. Analysts predict a moderate growth trajectory:

| Year | Minimum Target (₹) | Maximum Target (₹) |

|---|---|---|

| 2025 | 18 | 25 |

REC Ltd Share Price Target 2025: Price Target and Investment Strategy

Reliance Power Share Price Target 2030

Looking ahead to 2030, Reliance Power is expected to solidify its position as a key player in the energy sector. With a robust portfolio and a focus on innovation, analysts foresee significant upside potential:

| Year | Minimum Target (₹) | Maximum Target (₹) |

| 2030 | 35 | 50 |

Expansion in renewable energy projects.

Sustained profitability and debt reduction.

Positive market sentiment towards green energy initiatives.

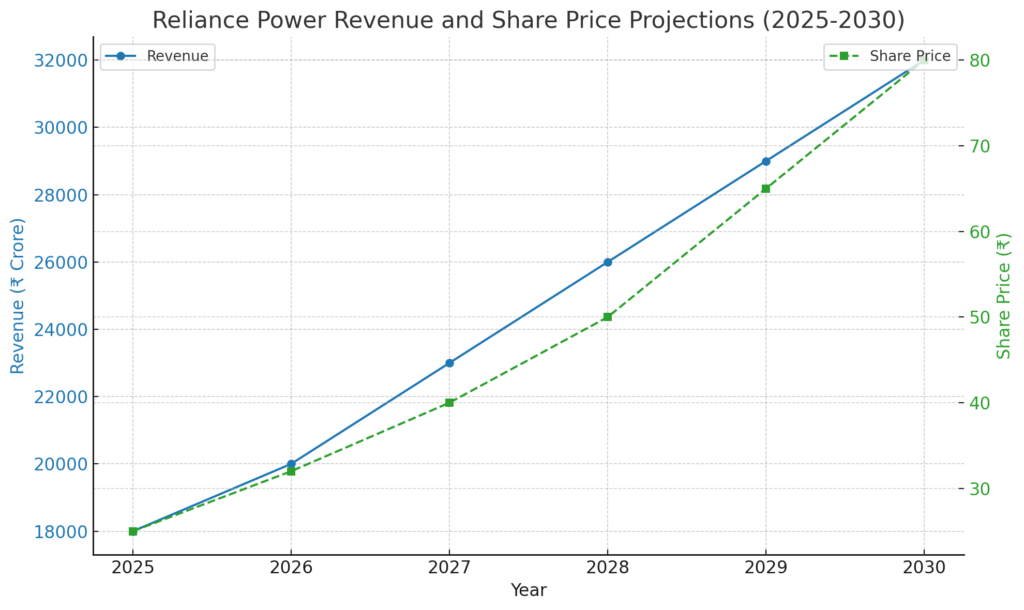

Graphical Representation of Reliance Power Share Price

Why Should You Consider Investing in Reliance Power?

Renewable Energy Focus

The company’s strategic shift towards renewable energy aligns with global trends and government policies, ensuring long-term sustainability.

Undervalued Stock

Reliance Power’s current market valuation may present an attractive entry point for long-term investors.

Growth Potential

The Indian power sector is poised for significant growth, and Reliance Power is well-positioned to capitalize on this opportunity.

Improved Fundamentals

Efforts to reduce debt and improve operational efficiency could lead to better financial performance, driving share prices higher.

Risks to Consider

While Reliance Power’s future appears bright, investors should be aware of potential risks:

- High Debt Levels: Although the company is reducing its debt, it remains a concern.

- Regulatory Challenges: Changes in government policies could impact the power sector.

- Market Volatility: Economic downturns and global events may affect stock performance.

Conclusion: Is Reliance Power a Good Investment?

Reliance Power’s share price target for 2025 to 2030 indicates a promising growth trajectory, backed by its focus on renewable energy and operational improvements.

By staying updated on the company’s performance and industry trends, you can make an informed choice about adding Reliance Power to your portfolio. With the potential for significant returns, this stock could be a valuable addition for long-term investors.