SAIL Share Price Target 2025 to 2030: Steel Authority of India Limited (SAIL), one of the largest steel producers in India, has shown resilience in adapting to market dynamics. Investors are keen on understanding its share price trajectory from 2025 to 2030, driven by its role in the steel sector and ambitious expansion plans. Below, we analyze its expected growth and influencing factors, while incorporating expert predictions and key metrics.

Financial Highlights (2024)

| Metric | Value (₹) |

|---|---|

| Revenue | 1.12 lakh crore |

| Net Profit | 12,850 crore |

| Debt-to-Equity Ratio | 0.32 |

| EBITDA Margin | 20.2% |

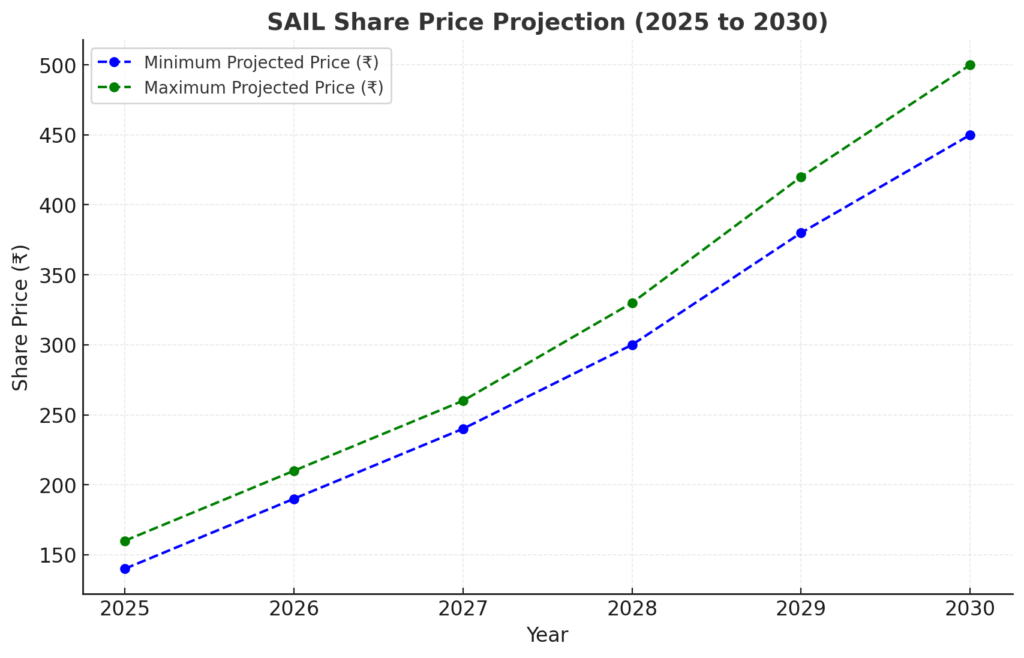

SAIL Share Price Predictions 2025-2030

| Year | Expected Price Target (₹) |

|---|---|

| 2025 | 140-160 |

| 2026 | 190-210 |

| 2027 | 240-260 |

| 2028 | 300-330 |

| 2029 | 380-420 |

| 2030 | 450-500 |

Factors Influencing SAIL’s Growth

1. Government Infrastructure Push

The Indian government’s focus on infrastructure projects and construction will boost domestic steel demand. This, combined with SAIL’s dominance in the sector, positions it to capitalize on increased requirements for structural and long steel.

2. Green Steel Initiatives

Global trends in decarbonization and SAIL’s commitment to sustainable steel production are expected to enhance its reputation and exports, potentially influencing share prices positively.

3. Privatization and Efficiency Gains

Potential government divestment in SAIL or operational efficiency improvements may lead to better profitability, making it an attractive investment.

4. Export Opportunities

SAIL’s increasing focus on exports, supported by favorable global steel prices, ensures better profitability margins in the coming years.

Projected Price Trends

2025 Target: ₹140-160

The combination of rising domestic demand and robust export growth could drive prices up. SAIL is also expected to benefit from cost reductions due to digital innovations in its plants.

2027 Target: ₹240-260

By 2027, SAIL’s efforts to increase production capacity (targeting 50 million tonnes per annum) and investments in green technology could yield results, propelling share prices further.

2030 Target: ₹450-500

SAIL is likely to achieve strong financials, with consistent revenue growth and lower debt-to-equity ratios. By 2030, its leadership in sustainable practices and high market share will position it as a leader globally, attracting more institutional investors.

Graphical Representation of SAIL Share Price Targets

Below is a projected graph for SAIL’s expected share price growth from 2025 to 2030. The trend assumes moderate growth aligned with macroeconomic indicators and industry demand.

Risks and Challenges

1. Market Volatility

Global economic slowdowns, geopolitical tensions, or falling steel prices could affect profitability and share price growth.

2. Rising Input Costs

Increased costs of raw materials like iron ore and coking coal could strain margins.

3. Competition

Private steel producers with better efficiency and newer technology might challenge SAIL’s market share.

Conclusion: SAIL Share Price Target 2025 to 2030

SAIL holds strong potential for growth between 2025 and 2030, driven by robust infrastructure demand, innovation, and global sustainability goals. While challenges exist, the company’s scale and strategic initiatives place it in a favorable position to deliver substantial returns for investors.

For the latest updates and deeper insights, consult reliable resources or expert analyses.