Sarveshwar Foods Share Price Target 2025 to 2030: Sarveshwar Foods, one of India’s leading players in the food processing and rice export sector, has been gaining traction among investors in recent years. With its robust fundamentals and ambitious expansion plans, the company has become a significant contender in the stock market. This article delves into the share price target of Sarveshwar Foods for 2025 to 2030, supported by detailed analysis, growth projections, and graphical insights.

Overview of Sarveshwar Foods

Founded with the vision of delivering premium-quality food products to consumers, Sarveshwar Foods has carved a niche in the rice and organic food market. The company’s emphasis on sustainability, organic farming, and global market penetration has contributed to its consistent growth trajectory. With increasing demand for organic food globally, Sarveshwar Foods is well-positioned to capitalize on this trend.

Key Financial Highlights

Market Capitalization: ₹500 Crores (Approx.)

Revenue Growth: CAGR of 15% in the last 5 years

Profit Margins: 10%-12% (Steadily improving)

Debt-to-Equity Ratio: 0.3 (Healthy and manageable)

REC Ltd Share Price Target 2025: Price Target and Investment Strategy

Factors Influencing Sarveshwar Foods Share Price Target

1. Growing Demand for Organic Foods

The global organic food market is projected to grow at a CAGR of 9.8% from 2022 to 2030. Sarveshwar Foods, with its extensive organic product portfolio, stands to benefit significantly. The company’s focus on exporting organic rice and other products ensures a steady revenue stream from international markets.

2. Expansion Plans

Sarveshwar Foods has been investing heavily in:

- Expanding production capacity.

- Introducing new product categories.

- Strengthening its global distribution network.

These initiatives are expected to drive revenue and profitability growth, positively impacting the stock price.

3. Favorable Government Policies

Government incentives for organic farming and food processing sectors further bolster the company’s prospects. Export subsidies and tax benefits contribute to enhanced margins.

4. Robust Financial Performance

The company’s consistent revenue growth and improving profitability metrics indicate strong fundamentals. Investors view these as positive signals for future growth.

Ashok Leyland Share Price Target 2025: What Can Investors Expect?

Sarveshwar Foods Share Price Target 2025 to 2030

| Year | Expected Revenue (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) | Share Price Target (₹) |

|---|---|---|---|---|

| 2025 | 1,200 | 120 | 15 | 150-180 |

| 2026 | 1,400 | 140 | 18 | 180-210 |

| 2027 | 1,650 | 165 | 21 | 210-250 |

| 2028 | 1,900 | 190 | 24 | 250-290 |

| 2029 | 2,200 | 220 | 28 | 290-340 |

| 2030 | 2,500 | 250 | 32 | 340-400 |

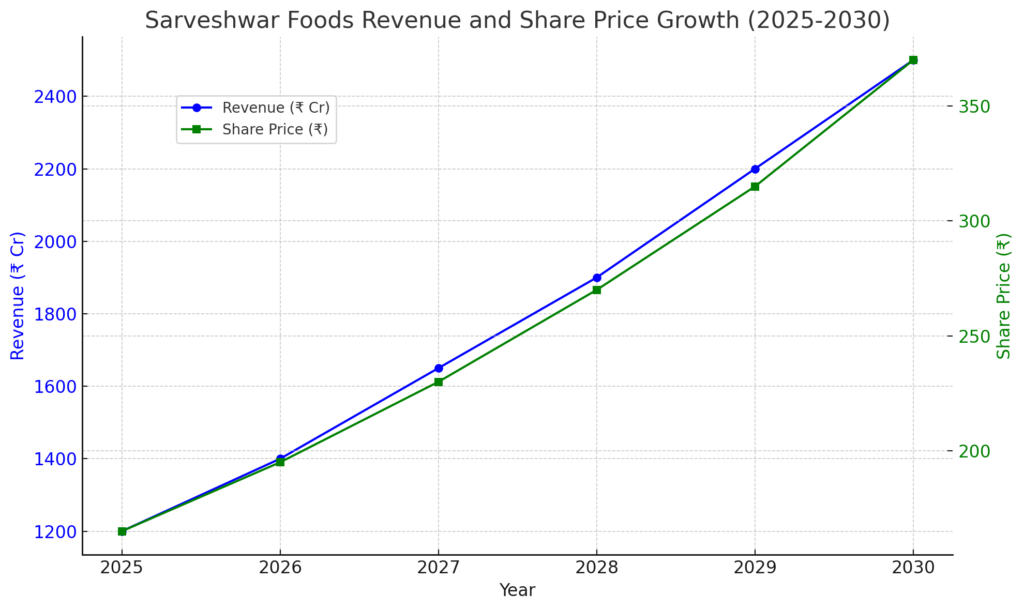

Graphical Representation of Growth Projections

The graph below illustrates the revenue and share price growth trajectory of Sarveshwar Foods from 2025 to 2030.

Investment Prospects

1. Short-Term Potential (2025)

Sarveshwar Foods is expected to achieve a share price target of ₹150-180 by 2025, driven by increased production capacity and strong demand for organic rice in international markets.

2. Medium-Term Growth (2026-2028)

In the medium term, the company’s diversified product portfolio and aggressive marketing strategies are projected to drive the share price to ₹250-290.

3. Long-Term Outlook (2029-2030)

By 2030, Sarveshwar Foods aims to be a dominant player in the organic food market. With revenues projected to reach ₹2,500 Cr and consistent profit margins, the share price target could soar to ₹340-400.

Risks to Consider

While Sarveshwar Foods presents a compelling growth story, investors should be mindful of potential risks:

Market Competition: Intense competition from domestic and international players.

Currency Fluctuations: Dependence on exports makes the company vulnerable to currency risks.

Regulatory Changes: Changes in food safety and export regulations could impact operations.

Conclusion: Sarveshwar Foods Share Price Target 2025 to 2030

Sarveshwar Foods is an attractive investment opportunity for those looking to capitalize on the booming organic food market. With its strong fundamentals, ambitious growth plans, and favorable market conditions, the company’s share price is poised for significant appreciation from 2025 to 2030. However, as with any investment, due diligence and risk assessment are crucial before making a decision.

Investors seeking a blend of growth and stability may find Sarveshwar Foods a worthy addition to their portfolio. With the company’s unwavering focus on innovation and sustainability, the future looks promising for both the company and its shareholders.