Sharp Investments Ltd Share Price Target 2025 to 2030: Sharp Investments Ltd, a non-banking financial company (NBFC), has been steadily carving out its position in India’s financial sector. With its focus on inter-corporate loans, personal loans, and trading in shares and securities, the company has generated significant interest among investors seeking opportunities in undervalued stocks. As of December 2024, Sharp Investments Ltd’s share price stands at ₹0.80, reflecting a potential opportunity for substantial growth in the coming years.

In this article, we will provide a detailed analysis of Sharp Investments Ltd, its financial performance, market position, and future share price projections for 2025 to 2030. Whether you are a seasoned investor or a newcomer, this report will give you actionable insights into this stock’s potential.

Current Financial Snapshot

Here is an overview of Sharp Investments Ltd’s financial metrics as of December 2024:

| Metric | Value |

|---|---|

| Current Share Price | ₹0.80 |

| Market Capitalization | ₹19.4 Crores |

| 52-Week High/Low | ₹0.97 / ₹0.65 |

| Book Value | ₹1.17 |

| Price-to-Earnings (P/E) | 0.00 |

| Debt-to-Equity Ratio | 0.00 |

| Return on Equity (ROE) | 0.01% |

| Dividend Yield | 0.00% |

These figures indicate that the company is debt-free and trading below its book value, making it an interesting prospect for long-term investors.

Business Overview

Sharp Investments Ltd operates in three primary segments:

- Inter-Corporate Loans: Facilitating financial arrangements between corporations.

- Personal Loans: Offering unsecured loans to individuals with flexible terms.

- Trading in Shares and Securities: Active participation in the equity markets to generate returns.

The company’s diversified operations provide resilience against market fluctuations and create multiple revenue streams. Despite its small size, Sharp Investments’ strategic positioning in the financial services sector holds promise for future growth.

Share Price Performance

Over the last year, the stock has demonstrated steady movement, showcasing its potential:

- 1 Week: Increased by 6.02%

- 3 Months: Increased by 11.39%

- 6 Months: Increased by 8.64%

While the stock has remained under ₹1, its consistent upward trend reflects growing investor confidence.

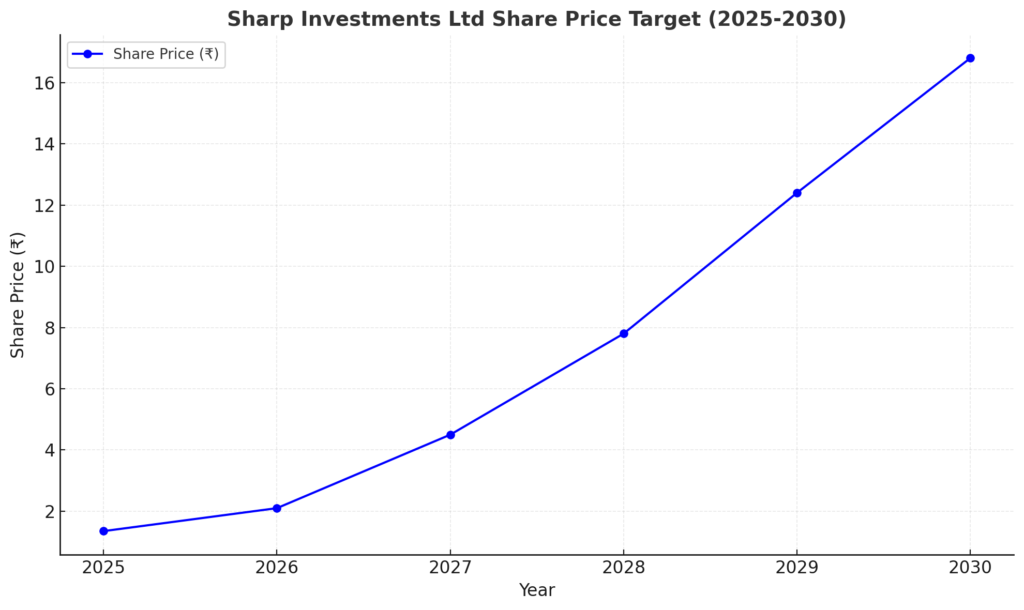

Projected Share Price Targets for 2025 to 2030

Based on current market trends, financial analysis, and industry growth rates, here are the estimated share price targets for Sharp Investments Ltd:

| Year | Minimum Price (₹) | Maximum Price (₹) |

| 2025 | ₹1.35 | ₹1.90 |

| 2026 | ₹2.10 | ₹2.80 |

| 2027 | ₹5.20 | ₹6.30 |

| 2028 | ₹8.50 | ₹10.50 |

| 2029 | ₹11.75 | ₹14.20 |

| 2030 | ₹13.50 | ₹16.80 |

The projected growth trajectory highlights the potential for multi-fold returns over the next five to six years.

Graphical Representation

Below is a graphical representation of Sharp Investments Ltd’s projected share price growth from 2025 to 2030:

The graph shows an upward trend, starting from ₹1.35 in 2025 and reaching ₹16.80 in 2030, indicating consistent growth.

Key Growth Catalysts

- Debt-Free Operations: Sharp Investments Ltd’s zero debt status enhances financial stability, providing it with greater flexibility to invest in growth opportunities.

- Undervalued Stock: Trading at just 0.70 times its book value, the stock appears significantly undervalued, offering room for price appreciation.

- Market Expansion: Opportunities to broaden its loan portfolio and trading activities could further boost revenue.

- Sectoral Growth: The NBFC sector in India is expected to grow at a CAGR of 10%, which bodes well for Sharp Investments.

Potential Risks

- Low Profitability: A return on equity (ROE) of 0.01% raises concerns about the company’s ability to generate profits.

- Lack of Dividend Payouts: The absence of dividends may deter income-focused investors.

- Market Volatility: Exposure to fluctuations in the equity markets could impact trading income.

Conclusion: Sharp Investments Ltd Share Price Target 2025 to 2030

Sharp Investments Ltd presents an intriguing opportunity for investors looking to capitalize on undervalued stocks. Its debt-free operations, strong potential for growth, and consistent share price performance make it a candidate worth considering. However, the low profitability and lack of dividends should be weighed before making investment decisions.

If the company can leverage its strengths and overcome its challenges, it could emerge as a multi-bagger stock by 2030. Investors are advised to keep a close watch on its quarterly results and industry developments to make informed decisions.