Suzlon Share Price Targets 2025 to 2030: Suzlon Energy Limited has been a cornerstone of India’s renewable energy revolution. As a pioneer in wind energy solutions, Suzlon has navigated through turbulent times but continues to emerge stronger with renewed focus and determination. With global and domestic policies pushing for sustainable energy sources, Suzlon’s role is becoming more critical than ever.

For investors, the burning question is: What lies ahead for Suzlon? Specifically, what are its share price targets for 2025 to 2030, and is this a stock worth holding for the long haul? Let’s dive into Suzlon’s market standing, financial health, and growth prospects to find the answers.

As of December 23, 2024, Suzlon’s share price trades at ₹15.50. Despite historical challenges, the company has gained momentum through strategic financial restructuring, increasing demand for renewable energy, and new project wins.

The Renewable Energy Boom: What It Means for Suzlon

The global push toward clean energy has created a golden opportunity for companies like Suzlon. Here’s why:

India’s Green Energy Commitments:

India aims to generate 50% of its total energy from renewable sources by 2030. Wind energy, Suzlon’s core business, plays a vital role in achieving this target.

Government Incentives:

Policies favoring wind and solar energy projects, coupled with subsidies, are helping companies like Suzlon scale operations.

Global Market Trends:

At a CAGR of 8.4%, the global renewable energy market is projected to grow from 2023 to 2030. Wind energy, which accounts for nearly 25% of the renewable energy mix, is a key growth area.

Financial Analysis

Over the years, Suzlon has worked on streamlining its finances, which has contributed significantly to investor confidence.

- Revenue Growth:

In FY24, Suzlon posted a revenue of ₹6,623 crore, a 16% year-on-year increase. - Net Profit:

After years of losses, the company recorded a net profit of ₹1,290 crore for FY24, signaling a major turnaround. - Debt Reduction:

Suzlon’s debt, which was once over ₹14,000 crore in 2019, now stands at ₹6,200 crore, thanks to aggressive financial restructuring. - Key Ratios:

- P/E Ratio: 15.2x (indicative of undervaluation compared to peers).

- Debt-to-Equity Ratio: Improved to 1.8, down from 4.5 in 2019.

Suzlon Share Price Targets 2025 to 2030

Based on market trends and Suzlon’s financial performance, here are the projected share price targets:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹60 | ₹75 |

| 2026 | ₹75.80 | ₹90 |

| 2027 | ₹90 | ₹110 |

| 2028 | ₹110 | ₹130 |

| 2029 | ₹130 | ₹150 |

| 2030 | ₹150 | ₹170 |

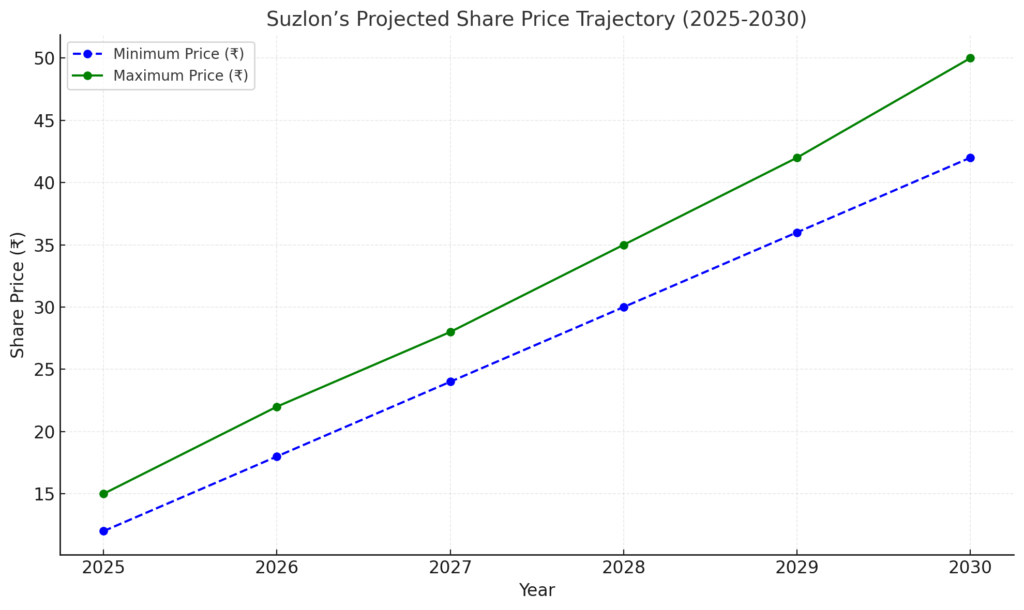

Graphical Representation: Suzlon Share Price Targets 2025 to 2030

Below is a visual representation of Suzlon’s projected share price trajectory:

The graph shows a steady upward trend, reflecting Suzlon’s potential growth amid favorable market conditions.

Factors Driving Suzlon’s Growth

Expanding Order Book:

Suzlon recently secured a major 302.4 MW wind project from Jindal Renewables, boosting its future revenue potential.

Technological Advancements:

The company is investing in next-gen wind turbine technology, enhancing efficiency and reducing costs.

Global Presence:

Suzlon’s foray into international markets diversifies its revenue streams and reduces dependency on domestic orders.

Government Backing:

Supportive policies and incentives for renewable energy projects strengthen Suzlon’s competitive edge.

Risks to Consider

While the outlook for Suzlon is positive, investors should be aware of the following risks:

- Market Volatility: Sudden fluctuations in energy prices or policy changes could impact the company’s performance.

- Debt Levels: Although reduced, Suzlon still carries significant debt, which may strain profitability.

- Execution Challenges: Delays in project implementation could affect revenue and margins.

Why Suzlon is a Smart Long-Term Investment

Dividend Potential: Suzlon’s improving financial health could translate into regular dividend payouts in the future.

Aligned with Global Trends: The shift towards renewable energy is irreversible, ensuring sustained demand for Suzlon’s products and services.

Turnaround Story: From reducing debt to reporting profits, Suzlon’s financial recovery is a testament to its resilience.

Affordable Entry Point: Trading at just ₹15.50, Suzlon is an attractive option for investors seeking high growth at a low cost.

Conclusion: Suzlon Share Price Targets 2025 to 2030

Suzlon Energy is more than just a stock; it’s a story of resilience, innovation, and immense potential. As the world pivots towards a greener future, Suzlon stands to gain significantly, making it an excellent pick for long-term investors.

However, like any investment, due diligence is crucial. Monitor the company’s performance closely and consult a financial advisor if needed.

Invest in Suzlon today and be a part of the renewable energy revolution!