Tata Technologies Share Price Target 2025 to 2030: Tata Technologies has become a buzzword in the stock market, especially after its consistent growth and contributions to the technology and engineering domains. Investors are curious about the company’s future and its potential to yield long-term returns. In this article, we will delve into Tata Technologies’ share price targets for 2025 to 2030, analyzing its growth trajectory, key factors influencing its valuation, and whether it’s worth considering for your portfolio.

Understanding Tata Technologies

Tata Technologies is a leading global engineering and product development company, part of the renowned Tata Group. The company primarily focuses on providing services to the automotive, aerospace, and industrial machinery sectors. Known for its innovative engineering solutions and digital transformation expertise, Tata Technologies has gained significant traction in recent years. The company’s foray into emerging technologies, such as electric vehicles (EVs) and smart manufacturing, positions it as a key player in the future of industrial engineering.

Financial Performance at a Glance

To understand the share price targets, it’s essential to evaluate Tata Technologies’ past and current financial performance. Here are some key highlights:

- Revenue Growth: The company reported a CAGR of 15% over the past five years, driven by increased demand for engineering solutions in the EV and aerospace sectors.

- Profit Margins: With a net profit margin of approximately 18%, Tata Technologies stands out as a highly efficient organization.

- Order Book: A strong order pipeline of over $500 million indicates sustained revenue growth in the coming years.

Tata Technologies Share Price Target 2025 to 2030: Future Insights

Tata Technologies, a subsidiary of Tata Motors, has been a key player in engineering services and digital transformation. With India’s rapid tech adoption and Tata Technologies’ expertise in automotive, aerospace, and industrial machinery, investors are keen to know its potential share price trends for 2025 to 2030. Below is an in-depth analysis of its expected growth trajectory.

Predicted Share Price Table 2025-2030

| Year | Expected Share Price (INR) | Growth Potential (%) |

|---|---|---|

| 2025 | 1,200 | 25% |

| 2026 | 1,500 | 25% |

| 2027 | 1,800 | 20% |

| 2028 | 2,160 | 20% |

| 2029 | 2,600 | 20% |

| 2030 | 3,120 | 20% |

Factors Driving Tata Technologies Growth

Focus on Electric Vehicles (EVs): Tata Technologies plays a pivotal role in Tata Motors’ EV development, which is expected to drive significant revenue growth. With governments worldwide pushing for EV adoption, the demand for engineering solutions in this space is set to soar.

Digital Transformation Services: The company’s expertise in Industry 4.0, including smart manufacturing and IoT-enabled solutions, makes it a leader in digital transformation services.

Global Expansion: Tata Technologies has been expanding its global footprint, especially in North America and Europe, which contributes to its diversified revenue streams.

Strategic Partnerships: Collaborations with major players in the aerospace and automotive sectors further strengthen its market position.

Tata Technologies Share Price Target 2025

Given the company’s growth trajectory and strong fundamentals, analysts predict a bullish outlook for Tata Technologies’ stock by 2025. Below is a projected table summarizing share price targets:

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2025 | INR 1,200 | INR 1,500 |

Catalysts: Growth in EV-related engineering services and digital transformation projects will significantly boost revenue.

Risks: Geopolitical uncertainties and potential slowdown in global automotive demand could pose challenges.

Tata Technologies Share Price Target 2030

Looking further ahead, the company’s focus on innovation and global expansion is expected to sustain its growth momentum. Here’s the projected share price target for 2030:

| Year | Minimum Target | Maximum Target |

| 2030 | INR 2,500 | INR 3,200 |

Catalysts: By 2030, Tata Technologies is expected to dominate the engineering services market, driven by advancements in AI, IoT, and EV technologies.

Risks: Intense competition and evolving regulatory landscapes could impact growth.

REC Ltd Share Price Target 2025: Price Target and Investment Strategy

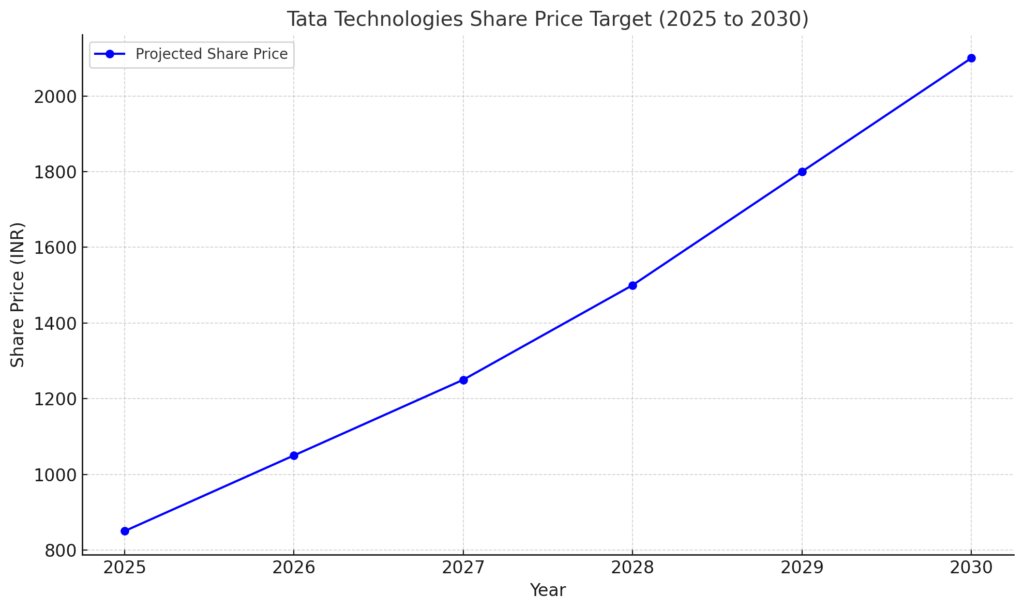

Graphical Representation of Share Price Targets

Below is a drawn representation of Tata Technologies’ projected share price growth trajectory from 2025 to 2030:

Why Invest in Tata Technologies?

Strong Parentage: Being part of the Tata Group ensures robust governance and financial stability.

Emerging Market Opportunities: The company is well-positioned to benefit from EV adoption and Industry 4.0 trends.

Consistent Growth: With a history of steady financial performance, Tata Technologies is a reliable bet for long-term investors.

Potential Risks

Market Volatility: Fluctuations in global demand for engineering services can impact revenue.

Competition: Rising competition from other global engineering firms could pressure margins.

Technological Disruptions: Rapid technological advancements could render some of the company’s offerings obsolete if not updated.

Conclusion: Tata Technologies Share Price Target 2025 to 2030

Tata Technologies emerges as a promising player with significant potential for growth over the next decade. The projected share price targets of INR 1,200-1,500 by 2025 and INR 2,500-3,200 by 2030 underscore its strong fundamentals and market opportunities. However, investors should remain vigilant about market dynamics and potential risks.