Union Bank Share Price Target 2025 to 2030: Union Bank of India, a cornerstone of India’s public banking sector, has been garnering significant attention from investors. Known for its reliability and transformative initiatives, the bank is poised to deliver substantial growth in the coming years. This article provides a comprehensive analysis of Union Bank’s share price targets for the years 2025 to 2030, diving into its financial performance, growth factors, and future potential.

Quick Overview

Union Bank of India has cemented its position as a trusted institution over the decades. With the government’s focus on financial inclusion and infrastructure development, Union Bank is set to play a vital role in the nation’s economic progress. Let’s dive into its market position, financial highlights, and share price forecast.

Market Position

- Leadership in Public Banking: Union Bank stands among the top public sector banks, with a strong presence across urban and rural India.

- Wide Reach: The bank serves millions of customers, providing services across retail, corporate, and agricultural banking segments.

- Digital Transformation: With 60% of transactions now digital, Union Bank is at the forefront of modern banking innovation.

Financial Highlights

Union Bank’s financial performance over recent years showcases its resilience and commitment to growth:

- Net Profit: ₹8,512 crore in FY23, marking a significant rise from ₹5,265 crore in FY22.

- Gross NPA Improvement: Reduced from 11.2% in FY19 to 6.37% in FY23.

- Earnings Per Share (EPS): Stood at ₹12.45 in FY23, indicating stronger returns for shareholders.

- Revenue Growth: A steady climb to ₹81,163 crore in FY23 reflects operational strength.

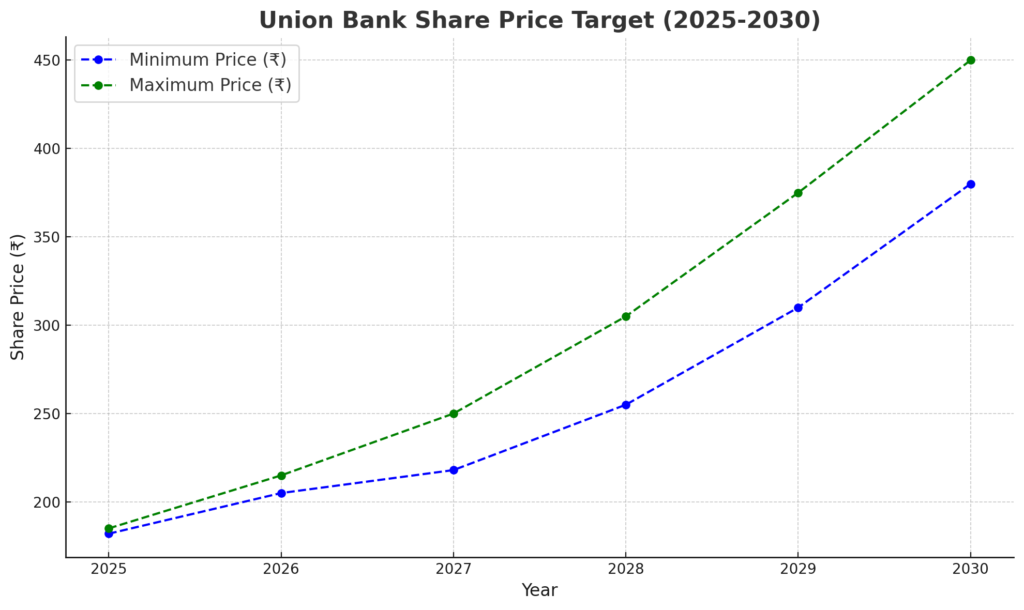

Share Price Target Table (2025–2030)

Here’s a detailed table of the projected share prices for Union Bank from 2025 to 2030:

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | 182 | 185 |

| 2026 | 205 | 215 |

| 2027 | 218 | 250 |

| 2028 | 255 | 305 |

| 2029 | 310 | 375 |

| 2030 | 380 | 450 |

Union Bank Share Price Year-by-Year Analysis

2025:

Union Bank is expected to stabilize at ₹182–₹185, driven by improving asset quality and sustained profitability. Retail banking will likely be a key growth driver.

2026:

Share prices may rise to ₹205–₹215 as the bank reaps the benefits of digital transformation and strategic partnerships.

2027:

Union Bank is projected to achieve ₹218–₹250. This growth will be fueled by increased rural penetration and a focus on reducing non-performing assets further.

2028:

With its digital initiatives maturing, the stock price may climb to ₹255–₹305, reflecting robust operational efficiency and new revenue streams.

2029:

Union Bank could touch ₹310–₹375 as economic growth accelerates, bolstered by better credit management and government policies favoring public sector banks.

2030:

The bank is expected to surpass ₹400, with a potential high of ₹450. By this point, Union Bank will likely solidify its position as a top performer in the public sector banking space.

Tata Technologies Share Price Target 2025 to 2030: Will It Be the Next Multibagger?

Graphical Representation of Union Bank Share Price Target 2025 to 2030

The graph below illustrates the projected growth trajectory of Union Bank’s share price from 2025 to 2030:

Key Factors Influencing Share Price

1. Digital Banking Revolution

Union Bank’s focus on digital banking is a major growth driver. Innovations in mobile banking, AI-powered solutions, and digital onboarding will enhance customer experience and operational efficiency.

2. Government Backing

As a public sector bank, Union Bank enjoys strong government support, particularly in terms of capital infusion and policy alignment.

3. Rural and Retail Banking Growth

India’s rural economy is expanding, and Union Bank’s deep penetration into semi-urban and rural areas positions it to capitalize on this growth.

4. Economic Environment

India’s growing GDP and focus on infrastructure development will create opportunities for increased credit growth and profitability.

5. Improved Asset Quality

The steady reduction in NPAs is boosting investor confidence, making Union Bank a strong contender for long-term investments.

6. Partnerships with Fintech Firms

Union Bank’s collaborations with fintech companies enable it to offer innovative financial products and services, further driving growth.

Conclusion: Union Bank Share Price Target 2025 to 2030

Union Bank of India is more than just a stock, it’s a story of resilience, innovation, and growth. For investors, it represents a golden opportunity to align with India’s growth trajectory while reaping substantial returns. Whether you’re a seasoned investor or new to the market, Union Bank’s performance from 2025 to 2030 could be a game-changer.