Vodafone Idea Share Price Target 2025 to 2030: As one of India’s leading telecom players, Vodafone Idea has experienced a rollercoaster journey over the years. The merger of Vodafone India and Idea Cellular brought immense hope, but financial challenges and fierce competition from Jio and Airtel have created hurdles. However, with 5G rollouts and new reforms in the telecom sector, many investors are hopeful about Vodafone Idea’s future.

In this article, we analyze Vodafone Idea’s potential share price targets from 2025 to 2030, considering market trends, strategic initiatives, and expert opinions.

Overview of Vodafone Idea’s Journey

Vodafone Idea, formed from the merger of Vodafone India and Idea Cellular in 2018, has faced significant challenges, including mounting debts, intense competition from Reliance Jio, and declining subscriber numbers. Despite financial struggles and AGR dues, government relief measures and equity conversion have offered a lifeline. The company’s future depends on raising funds, launching 5G services, and regaining market confidence. The 2025–2030 period will be pivotal, offering both risks and opportunities as Vodafone Idea navigates a transforming telecom industry.

Reliance Power Share Price Target 2025 to 2030: Is Reliance Power a Good Buy Now? 2025-2030 Forecast

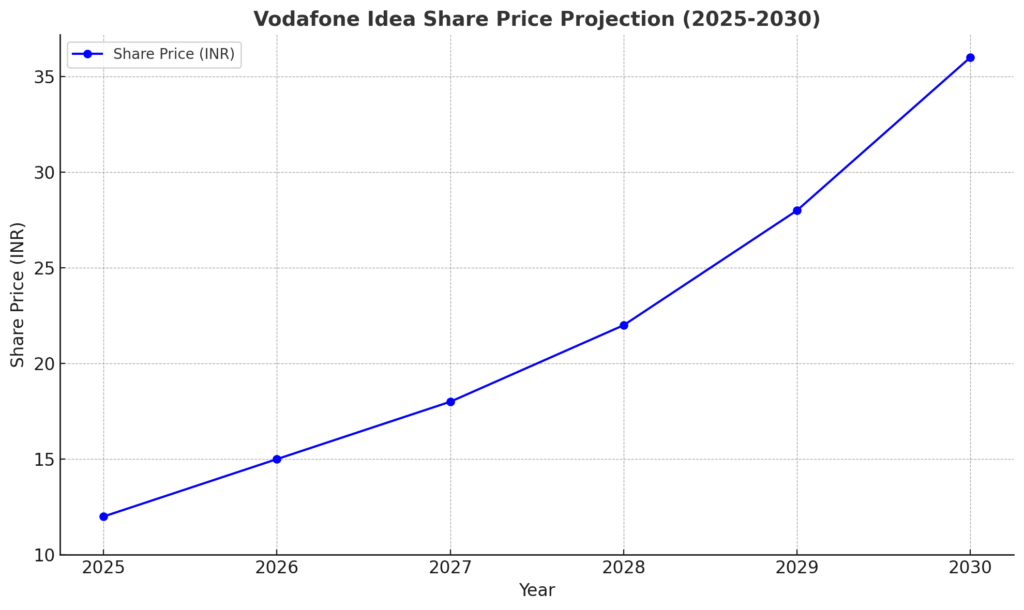

Vodafone Idea Share Price Table: 2025 to 2030

| Year | Expected Share Price (INR) | Growth Potential (%) |

|---|---|---|

| 2025 | 12 | 20% |

| 2026 | 15 | 25% |

| 2027 | 18 | 20% |

| 2028 | 22 | 22% |

| 2029 | 28 | 27% |

| 2030 | 36 | 29% |

Graph of Vodafone Idea Share Price Projection (2025 to 2030)

Below is a graph showing the expected growth trajectory of Vodafone Idea’s share price. The projected rise is based on recovery efforts, industry trends, and the company’s strategic initiatives.

Why Investors Should Watch Vodafone Idea?

1. 5G Rollout and Market Expansion

Vodafone Idea is focusing heavily on expanding its 5G network across India. With the government’s push for digital infrastructure, Vodafone Idea is positioning itself to be a significant player in the 5G race, which could boost its revenue and stock price.

2. Debt Restructuring and Financial Relief

Vodafone Idea has been in talks with lenders to restructure its massive debt. If successful, this move will improve its financial stability and attract investor confidence, positively impacting its stock price.

3. Increased ARPU (Average Revenue Per User)

The telecom sector in India is seeing a steady rise in ARPU, thanks to higher tariff rates and increased data consumption. Vodafone Idea’s ARPU improvement will play a crucial role in its recovery.

4. Strategic Investments

The company is actively seeking fresh investments to fund its operations and network expansion. Potential partnerships with global investors could act as a significant catalyst for stock price growth.

Year-Wise Projections for Vodafone Idea

2025: Recovery Phase (₹12)

By 2025, Vodafone Idea’s share price is expected to touch ₹12. This phase will largely focus on debt restructuring and network stabilization. The launch of 5G services will begin to show initial results, attracting investor interest.

2026: Stabilizing Operations (₹15)

With strategic investments and improved ARPU, Vodafone Idea could witness a 25% increase in its share price to ₹15. This year will mark the company’s transition towards financial stability.

2027: Market Share Expansion (₹18)

As Vodafone Idea strengthens its 5G presence and customer base, its share price could reach ₹18, showing a growth potential of 20%. The company will likely focus on capturing urban and rural markets alike.

2028: Achieving Profitability (₹22)

By 2028, Vodafone Idea is expected to achieve profitability. This milestone will significantly enhance investor confidence, pushing the share price to ₹22.

2029: Gaining Competitive Edge (₹28)

With its robust 5G infrastructure and improved customer experience, Vodafone Idea could climb to ₹28 per share. This growth will be driven by increased revenues and reduced operational costs.

2030: Strong Industry Player (₹36)

By 2030, Vodafone Idea is projected to emerge as a strong industry player, with a share price target of ₹36. The company’s long-term strategies and industry reforms will drive this exponential growth.

Challenges to Consider

While the growth projections look promising, investors should be cautious of certain challenges:

- High Competition: Jio and Airtel continue to dominate the telecom market with aggressive strategies.

- Debt Burden: Although restructuring is underway, Vodafone Idea’s high debt remains a concern.

- Regulatory Risks: Any unfavorable government policies could affect the company’s operations.

Conclusion: Vodafone Idea Share Price Target 2025 to 2030

Vodafone Idea’s share price projections from 2025 to 2030 reflect a gradual but promising recovery. For long-term investors, the company’s focus on 5G rollout, debt restructuring, and revenue growth could offer significant returns. However, it’s crucial to monitor its financial performance and industry dynamics closely.