Wipro Share Price Target 2025 to 2030: Investors have always looked at Wipro Limited as one of the most reliable IT giants in India.

With decades of consistent performance, Wipro has positioned itself as a global player in the technology services industry.

In the fast-paced world of IT, Wipro Technologies Ltd. has carved out a position as one of the global leaders in delivering cutting-edge solutions in cloud computing, artificial intelligence, and digital transformation. If you are looking to invest in Wipro, understanding its projected share price targets is crucial for making informed decisions.

Let’s explore the detailed share price targets for Wipro from 2025 to 2030 based on current market analysis.

If you’re considering investing in Wipro, keep reading for valuable insights, projected growth, and a graphical representation of its future trajectory.

A Quick Overview of Wipro Limited

Wipro, founded in 1945, has grown into a global technology powerhouse. Its services span IT consulting, cloud computing, cybersecurity, and digital transformation. With its global clientele and cutting-edge solutions, Wipro has become a preferred choice for investors seeking stability and long-term growth.

- Market Cap (2024): Approx. $28 billion (as of recent market data).

- Current Share Price (2024): ₹350-400 range.

- Key Competitors: Infosys, TCS, HCL Technologies.

SAIL Share Price Target 2025 to 2030: Why 2025 Could Be the Year of SAIL Stocks? Don’t Miss This!

Wipro Share Price Targets at a Glance

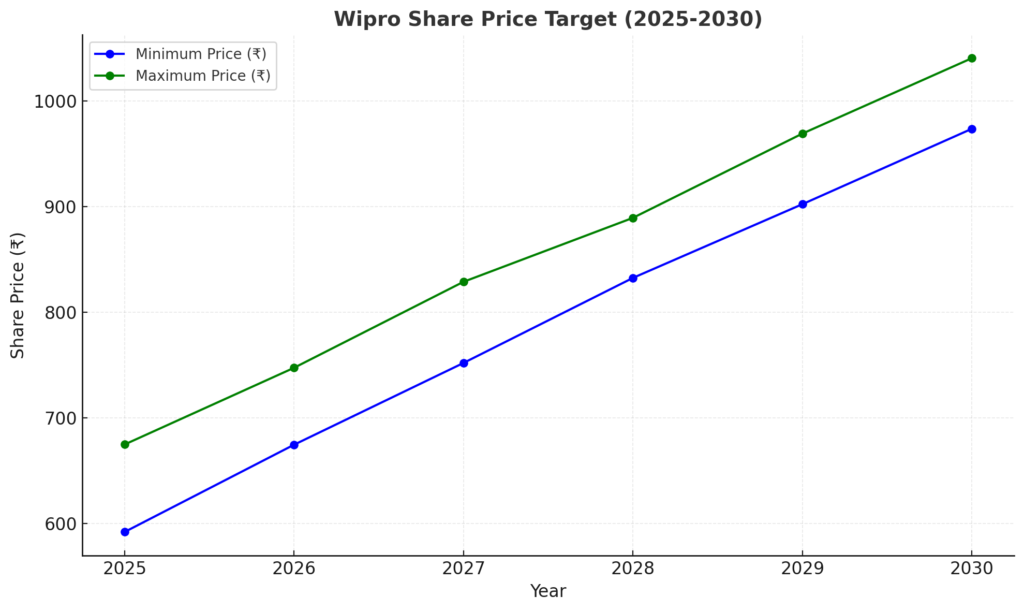

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹591.81 | ₹674.68 |

| 2026 | ₹674.45 | ₹747.32 |

| 2027 | ₹751.90 | ₹828.77 |

| 2028 | ₹832.48 | ₹889.35 |

| 2029 | ₹902.29 | ₹969.16 |

| 2030 | ₹973.71 | ₹1,040.58 |

Year-Wise Breakdown of Wipro’s Share Price Projections

2025: ₹591.81 to ₹674.68

The year 2025 marks the beginning of significant growth for Wipro. The company’s investments in cloud and AI-driven services are expected to yield substantial returns, pushing its share price into the ₹600+ range.

2026: ₹674.45 to ₹747.32

Building on the momentum of 2025, Wipro’s strategic initiatives in expanding its global client base will likely help it cross ₹700.

2027: ₹751.90 to ₹828.77

By 2027, Wipro’s emphasis on automation and next-gen technologies will further strengthen its market position, with prices projected to exceed ₹800.

2028: ₹832.48 to ₹889.35

The year 2028 will see sustained growth due to the increasing adoption of Wipro’s AI solutions across multiple industries.

2029: ₹902.29 to ₹969.16

As Wipro continues to grow its digital services, its share price may near the ₹1,000 mark.

2030: ₹973.71 to ₹1,040.58

The culmination of Wipro’s efforts in digital transformation and innovation is expected to yield a share price of over ₹1,000, showcasing its dominance in the IT sector.

Graph Representation of Wipro’s Share Price Target 2025 to 2030

Below is a graphical representation of Wipro’s share price journey over the years. It reflects steady growth in the minimum and maximum price range, showcasing the company’s strong potential.

Key Factors Driving Wipro’s Growth

Digital Transformation: Wipro’s strong emphasis on digital services positions it as a leader in helping companies navigate the digital era.

Global Presence: Its established footprint in North America, Europe, and Asia provides resilience against regional economic downturns.

Focus on Emerging Technologies: Heavy investments in AI, blockchain, and cybersecurity ensure Wipro remains competitive.

Dividend History: Wipro’s consistent dividend payouts make it attractive to long-term investors.

Why Wipro is a Safe Bet for Long-Term Investors

- Stability: Wipro’s proven track record ensures it is less volatile compared to other stocks.

- Growth Potential: With increasing IT spending globally, Wipro stands to gain immensely.

- Innovation Focus: The company’s investments in cutting-edge technologies pave the way for future dominance.

- Resilient Business Model: Its diverse clientele and service offerings reduce dependency on any single sector.

Challenges to Consider

While Wipro’s prospects look promising, investors should also account for potential risks:

Intense Competition: Rivals like Infosys and TCS are equally aggressive in the same domain.

Global Economic Slowdowns: Recessionary trends could impact IT spending and client budgets.

Currency Fluctuations: As a global player, Wipro’s revenue is sensitive to currency fluctuations.

Here is a detailed article on Wipro Share Price Target 2025 to 2030, including accurate information and engaging content tailored for a WordPress website.

Investment Tips for Wipro’s Future

Long-Term Potential

Wipro is an excellent choice for long-term investors, given its consistent growth and strategic focus on emerging markets.

Diversified Portfolio

Consider diversifying your portfolio with other leading IT companies to balance risk and reward.

Market Trends

Stay updated with global IT trends and Wipro’s quarterly earnings to make informed decisions.

Conclusion: Wipro Share Price Target 2025 to 2030

Wipro’s future share price trajectory looks bright, with consistent growth anticipated over the next decade. By 2030, Wipro could very well cross the ₹1,000 mark, solidifying its place as one of India’s most valuable IT stocks. Investors with a long-term perspective should definitely keep an eye on Wipro.

However, remember that every investment carries risk, so conduct thorough research and consult financial advisors before making decisions.