Zenith Steel Share Price Targets for 2025 to 2030: The steel sector in India plays a pivotal role in driving the country’s infrastructure and industrial growth. Among the companies striving to carve a niche in this competitive market is Zenith Steel Pipes & Industries Ltd. With its strong operational framework and an evolving business strategy, Zenith Steel has captured the attention of investors looking to ride India’s industrial wave. But the question remains, can Zenith Steel meet its share price expectations and reward its shareholders in the years to come?

In this article, we will explore Zenith Steel’s financial performance, market potential, and projections for its share price from 2025 to 2030.

Understanding Zenith Steel Pipes & Industries Ltd.

Founded as a reliable player in India’s steel manufacturing landscape, Zenith Steel Pipes & Industries Ltd. specializes in producing steel pipes and related infrastructure materials. With a robust product portfolio catering to various industries, oil & gas, construction, water supply, and more. Zenith Steel remains committed to quality and innovation.

- Current Share Price: As of December 24, 2024, the stock is trading at ₹8.02.

- Market Capitalization: ₹186.8 crore, reflecting its position as a mid-cap player in the steel industry.

- Product Portfolio: Mild steel pipes, galvanized steel pipes, and hollow sections.

- Key Clients: Zenith serves government projects, industrial companies, and global enterprises.

Financial Performance: A Resilient Growth Story

Zenith Steel’s financial track record showcases its resilience in the face of market fluctuations. The company has made strategic moves to cut costs and enhance efficiency.

Revenue Growth

Zenith Steel’s revenue has seen a consistent rise over the past three years:

- FY 2022: ₹138 crore

- FY 2023: ₹147 crore (6.5% growth)

- FY 2024 (estimated): ₹155 crore (5.4% growth)

This growth trajectory reflects increasing demand for steel products in infrastructure and industrial sectors.

Profitability

Despite revenue growth, profitability remains under pressure due to fluctuating steel prices and operational costs. In FY 2023:

- Operating Profit Margin (OPM): 9.3%

- Net Profit Margin (NPM): 3.5%

Debt Reduction

Debt management has been a key focus:

- In FY 2022, Zenith Steel reduced its debt by ₹20 crore.

- Debt-to-equity ratio improved from 2.8 to 2.1 over two years.

These efforts signal financial discipline and a move toward sustainability.

Market Trends Supporting Zenith Steel

India’s Infrastructure Boom

The Indian government has allocated ₹10 lakh crore for infrastructure development in FY 2024-25. This push toward urbanization and rural connectivity will drive steel demand, directly benefiting companies like Zenith Steel.

Global Steel Demand

The global steel market is projected to grow at a CAGR of 4.1% from 2023 to 2030, reaching $1.7 trillion. Zenith Steel’s export strategy positions it to capitalize on this trend.

Green Steel Initiatives

With rising environmental concerns, companies focusing on “green steel” have a competitive edge. Zenith Steel’s efforts to adopt sustainable practices could bolster its growth.

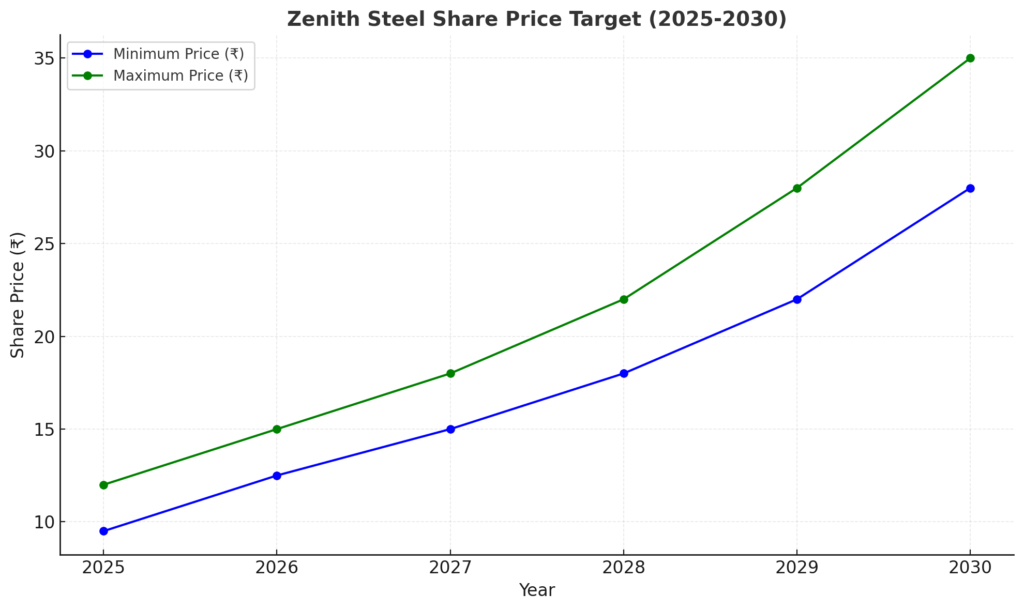

Zenith Steel Share Price Target: 2025 to 2030

Below are the projected share prices for Zenith Steel from 2025 to 2030, based on financial analysis, industry trends, and market conditions.

| Year | Minimum Price (₹) | Maximum Price (₹) |

|---|---|---|

| 2025 | ₹9.50 | ₹12.00 |

| 2026 | ₹12.50 | ₹15.00 |

| 2027 | ₹15.00 | ₹18.00 |

| 2028 | ₹18.00 | ₹22.00 |

| 2029 | ₹22.00 | ₹28.00 |

| 2030 | ₹28.00 | ₹35.00 |

Graphical Representation | Zenith Steel Share Price Targets for 2025 to 2030

To provide a clearer picture of Zenith Steel’s projected growth, here is a graph showcasing its share price targets:

Opportunities & Challenges

Opportunities

- Infrastructure Investments: Continued investment in roads, railways, and urban development.

- Government Policies: Supportive policies for the steel industry, including tax incentives and subsidies.

- Export Potential: Increasing global demand for steel pipes.

Challenges

- Market Competition: Stiff competition from established players.

- Volatility: Fluctuations in raw material prices.

- Regulatory Risks: Compliance with environmental regulations.

Conclusion: Is Zenith Steel a Good Investment?

Zenith Steel Pipes & Industries Ltd. offers a compelling growth story for investors, driven by strong fundamentals and favorable market trends. While challenges persist, the company’s focus on sustainability, financial discipline, and innovation positions it for long-term success.

Should You Invest?

If you are looking for a stock with moderate risk and significant growth potential, Zenith Steel could be a valuable addition to your portfolio. However, always conduct due diligence and consult with financial advisors.